Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2637-6679

Research Article(ISSN: 2637-6679)

Expectations in the Purchase of Health Insurance Plans: An Experiment in the City Of Barranquilla (Colombia) Volume 1 - Issue 4

Mario Alberto de la Puente Pacheco*

- Professor of Economic Development course at University of the North (Colombia), South America

Received: April 18, 2018; Published: April 25, 2018

Corresponding author: Mario Alberto de la Puente Pacheco, PhD in International Economics, full time professor of Economic Development course at Universidad del Norte (Colombia), South America

DOI: 10.32474/RRHOAJ.2018.01.000121

Abstract

This paper aims to replicate the Chew-Graham experiment [1] in order to determine whether the perception of quality for complementary medical insurance is biased and independent from its actual consumption in a different cultural and geographic context for two groups of consumers with different levels of coverage. This in order to contrast the standard insurance theory in which the perception of quality comes after the consumption of medical products and services. Through a U Mann Whitney and Kolmogorov-Smirnov statistical tests to 50 consumers of complementary medical insurance in the city of Barranquilla (Colombia) it is found that quality perception is different according to the type of policy that consumers have. Those insured who have policies with greater benefits, tend to have greater perception of quality of those who have policies with lower benefits. This experiment exposed the quality perception and the action of consuming medical services as independent variables not necessarily correlated.

Introduction

According to Sloan and Hsieh [2], health insurance companies fulfill several fundamental functions for the optimal functioning of medical services in both the public and private sectors. For the authors McCue, Hall and Xiu [3] there is a link between the consumption of medical services covered by insurance and the perception of quality only after the insured uses the insurance services, regardless of its geographical context and the type of insurance that is acquired. The perception of quality is given after the consumption of medical services and the additional benefits offered by insurance does not influence the quality perception of the policyholder before he/she uses the insurance. This implies a high degree of rationality of the consumers who apparently understand the scope of their medical coverage and do not have expectations of the services they acquire before they use it. This idea infers that policyholders are not influenced by additional medical benefits limiting their choice to their medical needs and budget constraints.

However, this way of relating the interaction between health insurance policies and policy holders does not reflect the role of subjectivity and its influence on people´s decision to purchase health insurances. In order to contrast the perspective of McCue and Hall, a survey was conducted to 50 medical insurance policyholders in the city of Barranquilla (Colombia) on the perception of various services offered by their insurance policies before being used following the experiment of Chew-Graham (2017) that highlights the possibility of having complementary medical insurance as a determinant for a high perception of quality before use it. The respondents were divided into two groups, the first group of 25 insured has additional benefits in their health insurance (spas, hydrotherapy, thalassotheraphy) while the other group of 25 does not. From a Likert survey ranging from 1 to 5, they were asked about three items: a variety of doctors and health centers that their insurance plan offer, medical attention and follow-up care after medical procedures, timely assistance before, during and after consumption of medical services.

It should be taken into account that none of the policyholders in the two groups had used their insurance policies until the date of the survey, which, according to McCue and Hall’s position, the surveys should show no perception of quality of their insurance plans before use it. The hypothesis of this experiment is that policyholders have different expectations in their medical insurance before using them because they have variable preferences (Gritcher and Cox, 1996) where policyholders are encouraged in different ways to select different health insurance that does not necessarily reflect a completely rational decision. In this sense, direct and indirect incentives [4] influence the creation of biases that influence the choice of policyholders, hence the creation of different expectations before the acquisition and consumption of medical insurance services.

Methodology and conceptual framework

A quantitative research methodology was used to analyze the results of quality perception based on a U Mann Whitney test and Kolmogorov-Smirnov tests that indicate whether the use non-parametric tests when minimum requirements or statistical assumptions are not met, such as small sample sizes (n <30), nonnormal data distribution. In other words, when there is a trend in the data and the variables are not continuous [5].

Hypothesis

The hypothesis is that the perception of quality of complementary medical insurance is no necessarily related to its consumption in a different cultural and geographical context. This is based on a Likert survey with three items with scale from 1 to 3 where 1 is a low perception and 3 a high. The first item asks about whether the insurance policy contracted offers a wide variety of medical centers and specialist doctors for their health care services. The second item asks about whether the insurance company continually assists its policyholders after a medical procedure. The third item asks about whether the insurance company provides timely assistance in the face of an adverse health condition. The first step of the study was the selection and verification of the suitability of the respondents in terms of having complementary medical insurance subscribed in the same period of time. Half (25) with complementary medical care benefits services and the other 25 without it, with similar policies in the availability of specialist doctors and health centers. In this step, insurers that had similarity in their policies with differences in complementary services were also selected. The second step was to carry out the survey of the target population based on the three items described above. The third step was the statistical analysis by means of the tests Test Kolmogorov Smirnov (KS) and Test U Mann Whitney in order to determine if the provision of complementary medical services affects the perception of quality of medical insurance even when these are not consumed.

Main objective

The main objective is to statistically determine the perception of quality of 50 insured surveyed in the city of Barranquilla with complementary medical insurance replying the Chew- Graham experiment in order to determine if the perception of quality varies for the two groups before they use their insurance benefits. The study population was divided into two groups; the first group 25 insured have the option to enjoy wellness medicine procedures (thalassotherapy, hydrotherapy and spas) with a lower co-payment than the individual payment of procedures. The second group of 25 is composed of policyholders who do not have this additional benefit even when both policies are very similar in coverage of medicines, clinics and number of physicians to which the insured can access. The sample was obtained on December 6, 2017, first group of policyholders’ states that they have not yet enjoyed the extra benefits of their policies.

Participants

Two groups of 50 individuals with complementary medical insurance in the city of Barranquilla were surveyed. The first group of 25 insured has a health insurance policy that offers coverage in complementary medical services (thalassotherapy, spa, and spa) and the other 25 insured do not have that additional benefit. Both groups of respondents have similar characteristics in gender parity (25 men and 25 women), education (both groups claimed to have a university degree), age (35-45 years) and per capita income (they claimed to have between 5-10 minimum legal monthly salary). The insurers that offer the two different medical insurance are are Colmedica Prepaid Medicine and Coomeva Prepaid Medicine. Both providers of complementary medical insurance.

This study was divided in three phases. In the first one, a characterization diagnosis of the participants was made in order to determine if they have similarity in levels of education, income, gender parity and ages. In the second stage, the target population was asked to complete a three-item survey on their perception of the quality of the two insurance policies in the city of Barranquilla. In the third phase it was determined if there is a differentiated perception about the quality of the health services through the Kolmogorov Smirnov Test (K-S) and the U Mann Whitney Test.

Parametric and non-parametric tests

Before the beginning of the statistical tests to prove the hypothesis, it is necessary to highlight an important element as a fundamental requirement to choose an appropriate statistical test. In this case, the difference between parametric and nonparametric tests will be briefly mentioned, in order to justify the usefulness of the U Mann Whitney test. Parametric statistics refers to the set of statistical procedures that allow knowing the distribution of the data, that is, if the data meet the necessary parameters to know what type of distribution the data has. On the contrary, if the distribution of the data is unknown and it is not known how these behave, then non-parametric tests should be applied. In addition, it is convenient to use non-parametric tests when minimum requirements or statistical assumptions are not met, such as small sample sizes (n <30), non-normal data distribution, that is, when there is a tendency in the data and its distribution is not in the form of a Gaussian bell and the variables are not continuous [5]. To apply parametric tests it is necessary to verify that the requirements or assumptions that conform to this type of tests are met.

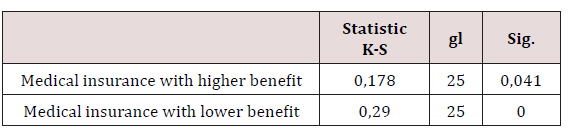

i. Test Kolmogorov Smirnov (K-S)

a. P-value> 0.05 → The data comes from a normal distribution, it is possible to use the parametric techniques.

b. P-value <0.05 → The data have an unknown distribution, it is advisable to use nonparametric techniques.

For the research case, this procedure was applied in order to determine the normality of the data, finding the following: As seen in table 1, the results show a p-value <0.05 for each group evaluated, that is, the data have an unknown distribution and do not meet the assumption of normality, therefore, it is acceptable to use non-parametric techniques for achieving the main objective.

Source: Own calculation with SPSS, 23.

U Mann Whitney test

The U Mann Whitney test is a type of non-parametric technique in which the purpose is to contrast the mean of a variable in two independent groups and verify whether it is different or not in a significant way. The U Mann Whitney test is the non-parametric alternative to the Student T test, when it is not possible to comply with the assumptions or requirements to apply it. This test is used when the observations of both groups are independent and the variables are ordinal or continuous (Scale from 1 to 3, ordinal), in addition, it is important to have the same size in both groups (in this case 25 surveyed in each group).

Procedure

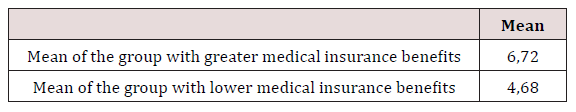

The perception of quality is composed of three variables: variety of services, support and timely medical assistance. However, to obtain a variable that would allow to include the general perception and also to compare both groups, the three questions evaluated were aggregated in order to achieve a total score for each respondent, where the highest total scores indicate a greater perception and On the other hand, lower total scores indicate a lower perception of quality. Given that the instrument consists of three questions, the highest possible score that both groups can obtain is 9 points, corresponding to answer High (3) in all. On the contrary, the minimum possible score that can be obtained by both groups is 3, corresponding to Low (1) in all the questions. In this way, the total score can be seen where the values close to the theoretical maximum (9) correspond to a better evaluation and the total scores close to the theoretical minimum (3) correspond to a low evaluation.

Once the total score of each respondent was obtained, the total average per group was obtained, as shown in table 2. It is observed that in the group with greater benefits, the perception of quality in general is higher than in the group with the lowest benefits. However, it is necessary to test whether this difference is statistically significant with the U Mann Whitney test.

Source: Own calculation with SPSS, 23.

Application and interpretation of U Mann Whitney test.

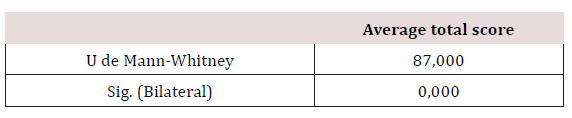

The U Mann Whitney test contrasts the hypothesis if the means of both groups are the same or on the contrary they do not present differences. In this case it can be expressed as follows:

a. P-value> 0.05 → The mean in both groups are the same.

b. P-value <0.05 → The mean in both groups are different.

The results shown by the statistical software allow to obviate all the manual procedure of calculation of the test and to obtain the necessary values for the statistical interpretation. Table 3 allows to evaluate if the average scores (perception) between both groups are the same or not (Table 3).

Group variable: Affiliation to medical insurance policy

Discussion and Conclusion

Since the value of significance (P-value = 0.000) is less than the value of statistical significance of 0.05 (P-value <0.05) interpretation is taken (b) and it can be affirmed that the perception of quality in both groups is different. With these statistical results, it can be said that the perception of quality of the insured according to the type of policy they have is different. Those insured who have policies with greater benefits, have greater perception of the quality of service than those who have policies with lower benefits. The results presented reinforce Chew-Graham´s position that expectations play an important role in the acquisition of health insurance, creating differentiated perceptions before the insured use their insurance. Although nothing is conclusive, this experiment serves as an element to identify the limitations of rationality in the decision making regarding the acquisition of medical goods and services.

References

- Chew Graham CA (2017) Broadening the reach of Health Expectations. Health Expectations 20(1) 1-2.

- 2. Sloan L, Hsieh C (2012) Health Economics. Cambridge: MIT Press, USA.

- McCue M, Hall M, Liu X (2013) Impact of medical loss regulation on the financial performance of health insurers. Health Affairs 32(9): 1546- 1551.

- Thaler R, Sunstein Cass (2008) Nudge: Improving Decision about Health, Wealth and Happiness. New Heaven: Yale University Press, USA.

- Rubio Hurtado MJY, Berlanga Silvente V (2012) How to apply the bivariate parametric tests of Student and ANOVA in SPSS. Practical case Magazine of Innovation and Research in Education 5(2): 83-100.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...

.png)