Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2643-6760

Review Article(ISSN: 2643-6760)

The Risk Management and its Importance in Medical Crisis Volume 5 - Issue 1

Evangelia Michail Michailidou1,2,3*

- 1Intensive Medicine Department, Hippokration General Hospital, Greece

- 2Senior Student in the Department of Business Administration, University of Macedonia, Greece

- 3Masters Degree, International Medicine-Health Crisis Management, Greece

Received: April 27, 2020; Published: May 11, 2020

Corresponding author: Evangelia Michailidou, Consultant Anesthesiologist-Intensivist, General Hospital Hippokratio of Thessaloniki, Konstantinoupoleos 46, Thessaloniki, Greece

DOI: 10.32474/SCSOAJ.2020.05.000202

Abstract

Risk is one of the parameters of our daily lives. Risk affects almost all the activities of the entities. It exists in all those cases in which it is not possible to predict with certainty the outcome of an activity. Even when we have backup processes in place to manage risk events, it is very likely that they will not be able to serve our needs. One way to handle this uncertainty is to have emergency stocks. We often have warning signs before an emergency occurs. There must also be a timetable, a nomenclature and a concept in relaxed circumstances and not in the middle of a crisis. In the crisis you have to modify the basic design and the alternative plans, because this is the crisis, modification of the plan, certainly no plan is set at the critical moment. There are often ethical dilemmas about crises and issues in crisis management, when the concepts of right, debt, duty and responsibility are simplified by procedures and choices.

Keywords: Risk; Management; Medicine

Abbrevations: ERM: Enterprise Risk Management

Review Article

Risk is one of the dimensions of our daily lives. Risk affects

nearly all of the operations of the institutions. It occurs in all

such situations in which it is not possible to forecast the result of

an operation with confidence. And though we have contingency

systems in place to handle crisis incidents, it is likely that they will

not be adequate to satisfy our needs and for sure not be sufficient to

fulfill our needs. Effective risk control involves a concerted attempt

to find possible causes of challenges. Even when we have backup

processes in place to manage risk events, likely, they will not be

able to meet our needs. One way to deal with this uncertainty is

to have emergency stocks. We often have warning signs before an

emergency happens.

Good risk management requires a systematic effort to

identify potential sources of problems. One of these is the use of

contingency reserves. The second is the transfer of risk, which

warns of an imminent problem. This is how we are implementing a

backup strategy. Sequencing is a common phenomenon associated

with risk events. One problem leads to another, which could lead

to another, and so on. As a result, a small problem could cause

extensive damage. Extraordinary events do not always have

catastrophic consequences, but their cumulative consequences

could lead to ineffective action. We may get to the point of repeating

things that have not been done for the first time. Even when we have

backup processes in place to manage risk events, likely, they will

not be able to meet our needs. Effective risk management requires

a careful selection of managers and managers. With effective risk

management, we can reduce the number of unwanted “surprises”

that we may encounter. Such events do occur, however, as we cannot

predict every possible case of danger. Part of our risk management

approach is to be able to prepare for a variety of adverse events.

The concept of danger factor as a threat is identified as a negative

event or as a threat to the company. Risk management in this sense

involves the usage of control [1-3].

Risk as Opportunity

Danger should be used as a source of planning, preparedness and training resources.

Danger and Uncertainty

As the risk is the spread of all future consequences, both good and negative strategies to reduce the risk or effect of an adverse incident without unnecessary costs. Risk reduction in this sense involves raising the gap between planned and real outcomes. Danger as a risk measure is challenged by the fact that it may be decomposed into two components:-The probability and effects of an occurrence happening. If we look at a threatening situation from chance, it depends on how much we believe it is risky [4,5].

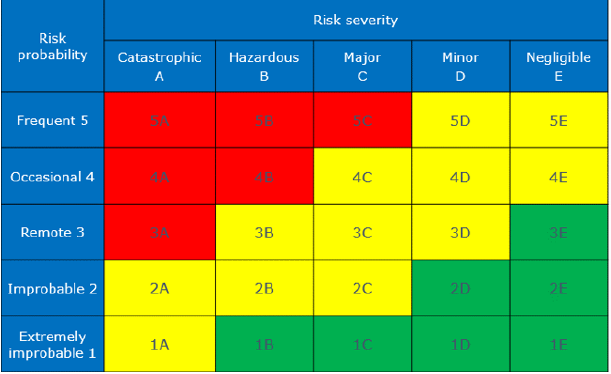

Assessment Matrix

A risk evaluation framework is a one-page monitoring tool-a a simple glance at the possible threats measured in terms of the possibility or probability of the danger and the magnitude of the implications. A risk assessment matrix is simpler to create because much of the details required can be quickly derived from the risk assessment type. It is achieved in the context of a clear table where the risks are listed based on their probability and the severity of the harm or the type of repercussions that the risks that have (Figure 1).

Creating a risk management diagram is the second phase in

the risk reduction cycle which parallels the first stage of filling

out a risk evaluation questionnaire to define possible risks. The

planning of a risk assessment matrix is a more complex process

that includes the detection of threats, the compilation of risk

evidence, the estimation of risk likelihood which effect thresholds,

the analysis of implications, the setting of goals and the creation of

risk management approaches.

On the other side, the risk management framework presents

the manager with a simple description of the threats and the

urgency for any of these threats has to be tackled. There is also

a difference between the definition of risk and the definition of

ambiguity. We know the likelihood of the risk we are contemplating

when making decisions under risk conditions. We don’t learn about

making choices in conditions of risk. When you are conscious of the

probability of a case, you have more knowledge at your fingertips

than if you were not. Therefore, stronger choices may be made

under dangerous conditions than under ambiguity. The pure risk

applies to circumstances in which there is just a failure and there

is no gain. As a consequence, the future consequences of actions

or incidents that involve mere threats can be detrimental or zero.

A large emergency response unit is in danger of undermining

the rescue activity for several reasons. Things of this nature are

overwhelming the squad with defeats. They are unacceptable

circumstances, so they can only contribute to losing.

Dynamic and Static Risks

Dynamic risks are synonymous with circumstances of instability created by an ever-changing culture, environmental shifts, demands, team composition, and technologies • Static risks are those that occur only in the absence of these adjustments and typically correlate with simple risks.

Internal and External Risks

Many threats are embedded in the unique operational

background of the rescue mission. Examples involve risks involved

with the usage of obsolete facilities, an insufficient workforce, etc.

a. Several of such hazards, particularly those relating to the

execution of activities, maybe mitigated by fixing the root of the issues e.g. obsolete facilities must be repaired, staff may be

educated and professional workers may be employed.

Risk Management

Risk Management is a method of identifying and resolving the

challenges that crisis management workers ultimately encounter

through their attempts to accomplish their goals.

a. Risks are typically categorized into categories such as

environmental, technical, economical, legal, knowledge and

staff

b. Enterprise Risk Management (ERM) is an example of an

advanced risk reduction approach

Danger Management

a. The application of organizational risk management

preserves and improves its importance by facilitating the

accomplishment of its objectives:

providing a collaborative structure that enables increasing

potential operation to be carried out in a coherent and managed

manner-improving the decision-making cycle, preparation and

prioritization-contributing to more effective usage/Distribution of

capital and energy within the group-protecting and improving team

assets and image-developing and improving people and business

knowledge-optimizing organizational performance.

Risk Identification

The goal is to assess the group’s sensitivity to instability. It needs a comprehensive knowledge of its policy and of the legal, societal, financial, economic and technical context in which it operates. Detection includes a methodical process to ensure that all main operations are detected and that any threats resulting from such operations are established.

Risk assessment approaches include: Danger workshopsstakeholder consultation-Benchmarking-Script review or “what If” review-auditing and inspection-research techniques (interviews, surveys, etc.) -cause and impact diagrams.

Risk Assessment: Risk Assessment is the method that we pursue to evaluate the origin of the risk incident, the risk incident itself, and the effect and pace of the risk case. The risk evaluation can be quantitative, semi-quantitative or qualitative in terms of the probability of an event and the possible implications. The effect evaluation of rising risk can be carried out using several tools: -Probability analysis -Scenario analysis-simulations-Error trees- Risk mapping-SWOT analysis-Cost benefit analysis-Reliability analysis. Risks are measured differently by various individuals. The distinction is attributed to the following factors: -Experience -Knowledge -Culture- Position in the team hierarchy -Economic situation - Ability to influence the result - Asymmetry between success and loss.

\Experience: Individuals with inexperience are not quick to recognize possible threats or, whether they can, minimize the likelihood that they may be harmed. Knowledge: not everyone has the same amount of awareness or details regarding a scenario, and it is not paradoxical that someone with less experience would be more positive regarding future outcomes. – In recent years, the amount of information accessible has improved by expanded coverage, science journal papers, the media, powerful advocacy organizations, etc., thereby raising people’s perception of threats.

Culture: Operational, national and regional cultures may have a huge effect on how risk is treated, especially in a centralized, regulated system where the prevailing perspective is sometimes overlooked by others.

Position: Senior and junior personnel in crisis management departments are expected to perceive threats differently owing to their roles in the hierarchy. It is partially attributed to training and expertise, although it can also be influenced by the degree to which the danger is caused.

Financial situation: The danger can contribute to an economic result of a critical economic significance at the level of the company or the state. Effect on the result: Someone who is willing to affect the results of an incident can perceive the danger involved with it differently. For certain instances, there is, of example, an overestimation of the possibilities, theoretically known as the Dunning - Krugger Effect, as we had mentioned in another work of us.

Asymmetry: Many individuals can cope more intensely with the effects of failure than with income. The comprehensive risk evaluation will address the following questions: –How long should we consider the danger (time)-how high is the possible risk (size of exposure)-what is the likelihood (likelihood) – How close to the predicted result is the risk occurrence (uncertainty)

Risk Analysis: considering the risks involved and the interaction with the threats of the crisis management team

a. Determining the interdependence of the threats identified with the risk potential.

b. Designing the right risk solutions based on the assessment carried out in the previous phase. (Execution).

c. Which is the method of collection and execution of risk control steps?

d. The goal for risk management is to define a set of suitable steps that can shape a cohesive and systematic approach to ensure that the net risk balance remains below the permissible range of exposure.

e. There is no appropriate solution to the danger answer.

f. The decision relies on factors such as the risk- of the company, the effect and probability of the danger happening, and the risks and advantages of the danger control programs. Establish the risk reduction approach after defining the threats and providing a fair estimate of the likelihood and severity of the effects of the risk occurrence, the risk solution must be determined. The solutions are as follows: – Accept the risk as it stands (Risk Acceptance) – Take action to reduce the risk and the degree of impact of the event (Risk Mitigation) – Transfer it by risk transfer – Do not accept risk acceptance – Avoid it by taking action to stop risk-taking, e.g. risk-avoidance (Monitoring)

g. Monitoring involves the communication of risk across the organization.

h. Requires regular risk assessment and tracking at various layers of administration, risk boards, and internal auditors. Other monitoring tools are: –Balanced Scorecards – Dashboards – Governance and Enforcement Systems – Threat Analysis System (Assessment)

i. Identify the benefits and limitations in the threat control system in comparison to the group’s strategic goals. • Risk Optimization / Value Generation.

j. the role of risk management in governance tracking the outcomes of risk management.

When trying to limit risk we should: –To regularly reassess the danger and ensure that it has not improved – and guarantee that there is a fair incentive for coping with it. –Let out future strategies to cope with negative situations that can happen as a consequence of our actions. Risk management • Compromise between taking a high risk and not taking the adequate risk to identify possibilities for effective mitigation. • Assessment of different cost-return results

• Analysis of risk management and decision-making processes, ensuring the appropriate use of financial capital and offering the required security.

Reporting: The various stages of the company need specific knowledge from the risk assessment method. The findings of the assessment will be conveyed to: Within the group/To the Board of Directors /In Company Units/To the employments

The decision-maker should:

a. -know what are the most significant challenges affecting

the organization - be informed of the future impact -ensure an

acceptable amount of knowledge around the ICU -knows how

the team can cope with the crisis

b. -recognizes the value of stakeholder trust in the group

c. -knows how to interact with the rest of the organization

as needed

d. -the risk management mechanism must operate effectively

e. -publishes a consistent risk management strategy that

describes the risk management approach of the external world.

The Decision-Making teams should:

be mindful of the threats that come beyond their scope of expertise, the possible effects they might have on certain business entities and vice versa-use success metrics to enable them to track core operations, progress towards targets and recognize processes that need action (e.g. predictions and calculations) -Systems that detect anomalies in estimates and predictions at the correct level to allow them to be resolved immediately – Report regularly and promptly to the senior officer on any potential danger or deterioration in current control measures as soon as they are introduced – Monitoring

Personnel should

-understands the challenges inherent at the entity levelunderstands how to promote quality progress in the effective approach to the risk management cycle and-understands that risk management is efficient where comprehensive and timely input is given to senior executives about all potential threats detected or shortcomings in current control measures.

Reporting – Stakeholders

a. The Crisis Management Department will comment on

risk control strategies and the success of meeting the targets to

stakeholders at frequent intervals.

b. Crisis response organizations will be asked to include

examples of good monitoring of non-financial results in fields

such as corporate social accountability, regard for human

rights, fair policies, health, and safety.

Reporting – Stakeholders

Strong leadership needs crisis management teams to follow a holistic risk reduction methodology that:- protects the rights of stakeholders-ensures that the Board continues to direct the plan such that it produces efficiency and regularly tracks performanceensures that safeguards are in place and well-controlled. The drawback is that in periods of distress, often individuals have a dream, a need for influence, and at periods without awareness and experience, literally issuing orders that may be lethal. It is a common trend that is undesirable in periods of disaster, culminating in casualties and complexities.

Conclusion

As a result, there is chaos and revolt in the present phases, which are burdened by the effects of erroneous orders. There must also be a timetable, a nomenclature and a concept in relaxed circumstances and not in the middle of a crisis. In the crisis you have to modify the basic design and the alternative plans, because this is the crisis, modification of the plan, certainly no plan is set at the critical moment. There are often ethical dilemmas about crises and issues in crisis management, when the concepts of right, debt, duty and responsibility are simplified by procedures and choices

References

- Baum W (2017) Understanding Behaviorism. Behavior, Culture, and Evolution. (3rd edn) Wiley Blackwell, Hoboken, New Jersey, USA.

- Thaler RH (2015) Misbehaving: The Making of Behavioral Economics. W.W. Norton & Company, New York, USA.

- Wright JF (2018) Risk management: A behavioral perspective. Journal of Risk Research 21: 710-724.

- Schmidt AL, Zollo F, del Vicarioa M, Bessi A, Scala A, et al. (2017) Anatomy of News Consumption on Facebook. 2017.

- Evangelia Michailidou (2019) Simulation Programs in Disaster Medicine.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...