Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2637-4749

Review Article(ISSN: 2637-4749)

Evaluation on Trend of Imported Rennet and Dairy Machinery to Ethiopia - A Review Volume 4 - Issue 2

Almaz Genene*, Kayo Garamu and Ararsa Gutema

- Milk and Milk Product Research Processing Industry Development Directorate, Ethiopian Meat and Dairy Industry Development Institute, Ethiopia

Received: October 13, 2020; Published: November 06, 2020

Corresponding author: Almaz Genene, Milk and Milk Product Research Processing Industry Development Directorate, Ethiopian Meat and Dairy Industry Development Institute, Bishoftu, Ethiopia

DOI: 10.32474/CDVS.2020.04.000182

Abstract

The current work summarizes the trends of imported rennet and dairy machinery as the Dairy sector is where the concept of value addition has been successfully adopted along the supply chain and results benefits value chain actors. Rennet is crucial input for dairy industry especial for cheese production and as it is a proteolytic enzyme main contains pepsin and chymosin extracted from animals and microbiological sources especially from suckling forth stomach of calf and other ruminant mammals. As cheese production grows the demand of the general all milk coagulating enzymes also increasing. The global coagulating enzymes market is segmented by based on nature of product that is either source of origin or form. In Ethiopia, the dairy industries use imported commercial rennet for cheese production since there is no industry that can produces rennet in the country and the industries use different dairy machinery imported for processing. Ethiopia imported about 10,226.23 kg in net weight rennet for the last ten-year 2007 to 2016. To import this volume the country had spent 1,843,749.09 Ethiopian Birr or 107,007.6597 Dollar of United States of America. Similarly, within the same last ten years Ethiopia imported dairy machinery in net weight around 337,119 Kg from different 22 countries and to import this volume the country had spent 110,340,118 Ethiopian Birr.

Keywords: Rennet; Dairy Machinery; volume; value

Introduction

Large and diverse livestock genetic resources, increasing

domestic demand for milk and milk products, higher market

opportunity and proximity to international markets indicate

the potential and opportunities for dairy development [1].

Faster increases in population and urbanization lead to growing

demand for dairy products [2,3]. While having promising policy

and institutions encourage investments in the dairy sector [4]. In

Ethiopian, the type of milk and dairy products that mostly know

include whole liquid milk and traditional fermented dairy products

(butter, ghee, ergo, ayib, metata ayib, ititu, butter milk etc. [5].

However, as reported on [6] a wider variety of domestic dairy

products including yogurt, fruit flavored yogurt, UHT milk, ice

cream, cultured milk, and cheeses such as mozzarella, provolone,

and Gouda. This indicates that milk processing is both cottage and

industrial processing type [7]. Dairy sector is one of the few sectors

where the concept of value addition has been successfully adopted

along the supply chain and results benefits directly to households

and in directly for suppliers of farm input, dairy equipment, dairy

ingredients, raw milk traders, milk transporters, milk processors

and distributors [4].

Rennet is crucial input for dairy industry for cheese production

and it is a proteolytic enzyme mainly contains pepsin and chymosin

extracted from animals and microbiological sources especial from

suckling forth stomach of calf and other ruminant mammals [8].

Milk-clotting enzyme is the first active agent in cheese making and

an essential ingredient for the production of various cheese types

[9]. Since coagulant directly reacts with casein that constitutes the

main component to produce cheese by cleaving Phenylalanine105–

Methionine106 bond of k-casein (kappa-casein) of casein [10-12].

As cheese production grows the demand of the enzyme rennet or in general all milk coagulating enzymes also increasing this is

why rennet is main ingredient for cheese making [13]. The global

rennet market is segmented by based on nature of product that

either source of origin or form. Due that the market is grouped

based on origin into animal-derived rennet, microbial rennet, FPCFermentation

Produced Chymosin rennet and vegetable rennet.

Dairy processing industry transforms raw milk into finished

products like fluid milks, creams, yogurt, fermented milk products,

butter, ice cream, cheese and ingredients further processed in the

form of concentrated or dried milk ingredients [14]. In Ethiopia,

the local industries use imported commercial rennet for cheese

production since there is no industry that can produces rennet

in the country and the industries use different dairy machinery

imported for processing. Therefore, the main objective the current

work is to review available information on the amount of imported

and value spent to import rennet enzyme and Dairy Machinery that

can provide for further intervention work.

Volume and value of imported rennet

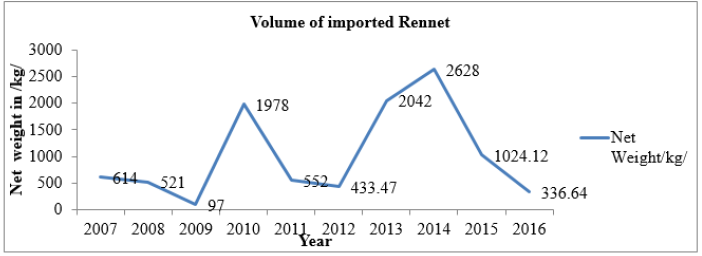

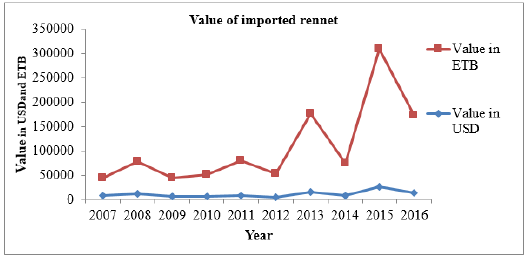

Ethiopia imported about 10,226.23 kg in net weight rennet for the last ten-year 2007 to 2016. From which the heights volume is 2,628 kg in 2014 followed by 2,042 kg in 2013, 1978 kg in 2010, 1,024.12 kg in 2,015,614 kg in 2007, 552 kg in 2,011, 521 kg in 2008 respectively, from which the lowest volume is 97 kg in 2009 followed by the second lowest 336.64 kg by the year 2016 (Figure 1). To import this volume the country had spent 1,843,749.09 ETB /Ethiopian birr/ or 107,007.6597 USD (Dollar of United States of America) in the past ten years from 2007 to 2016 (Figure 2). This indicates that on average the country has spent 18, 4374.9 ETB or 10,700.77 USD to import 1,022.623 kg rennet on average for the last past ten concoctive years (2007-2016).

Figure 1: Volume of imported rennet to Ethiopia by years (2007-2016).

Source: The data is calculated by the authors from Ethiopian Custom and Revenue Authority.

Figure 2: Value of imported Rennet to Ethiopia in ETB and USD by years (2007-2016).

Source: Ethiopian Custom and Revenue Authority.

Country of origin of imported rennet to Ethiopia

The major manufacturers of rennet across the global market are WalcoRen, Vahgan EV. Tigra Co Ltd, Iran Industrial Enzyme Co, Bioactive Yeast Co., Ltd. (Tailong Food), Yangzhou Chemical Co. Ltd, Scientific and Technological Bio resource Nucleus, Chr. Hansen Holding A/S, DuPont Nutrition & Health, Finest Kind, Sudarshan Biotech Ltd, RENCO New Zealand, MAYASAN Food Industries A.S [15]. The imported rennet to Ethiopia was products of different counties which were around ten including China, Belgium, Germany, Switzerland, Netherland, France, Denmark, Italy, India, Egypt, United Kingdom and South Africa. The highest market share of rennet was products of china which was about 3,028 kg and 29.49 % of the total volume within ten years (2007-2016). The second volume was products of Belgium which was about 2,363 kg or 23.02% of the total volume while the lowest volume was from South Africa 5 kg which was 0.05% of total imported volume within the last ten years (Table 1).

Table 1: Countries from where Rennet is imported to Ethiopia.

Source: Ethiopian Custom and Revenue Authority.

Import of dairy machinery to Ethiopia

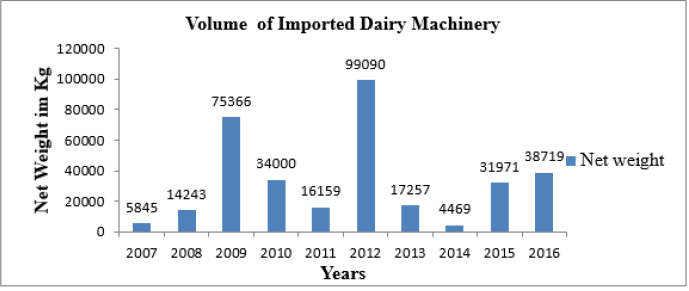

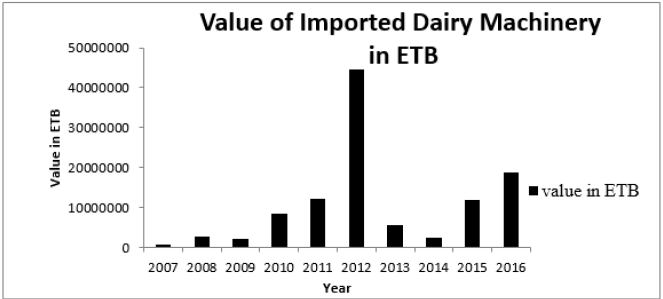

Dairy processing equipment includes machinery like pasteurizer, homogenizers, mixing & blending equipment, membrane filtration, separation, and evaporators & dryers used in production of yogurt, cheese, powdered milk, pasteurized milk, protein concentrates and cream. Growth of global milk consumption & production rate attended with increase in automation process for manufacturing is expected to motivate global dairy processing equipment industry growth [16]. As data show for the last past years 2007- 2016 Ethiopia had imported around 33,7119 Kg dairy machinery in net weight from different 22 countries (Figure 3 & Table 2 ) to import this volume the country had spent 110,340,118 Ethiopian birr (Figure 4). As indicated in Figure 4 the value of imported Dairy machinery for the years 2007,2008, 2009,2010, 2011,2012, 2013, 2014,2015,2016 was 704313,2686356, 2315101, 8645468, 12222359, 44474928, 5778930, 2632317, 11930647 and 18949700 ETB respectively. Implementation of energy-efficient technologies, shifting in consumer need, technological innovations utilize new ideas, technology and scientific concepts were factors for the introduction of new dairy products that intern forces the dairy equipment manufacturers to introduce newer equipment and technologies for dairy processors [17].

Table 2: Import of Dairy Machinery from Countries to Ethiopia (2007-2016).

Source: Ethiopian custom and revenue Authority.

Figure 3: Volume in Kg of imported Dairy Machinery to Ethiopia in years 2007-2016.

Source: Ethiopian custom and revenue Authority.

Figure 4: Value of imported Dairy Machinery to Ethiopia in ETB (2007-2016). Source:Ethiopian custom and revenue Authority.

Country of origin of imported dairy machinery to Ethiopia

Ethiopia had imported Dairy machinery in last ten years (2007- 2016) from different 22 countries from which the highest share was products of India that was about 101,558.46 kg net weight that caver 30.13 % of total import of 337119.98 kg which was followed by products of Italy 101,158.44 kg net weight or 30% of total import, Bulgaria 45,276.5 kg or 13.43%, China 22,288.25 kg, Netherlands 20,969.03 kg with ranks respectively (Table 2). On the other hand, the lowest volume import was original product of Belgium which was 6 kg net weight.

Conclusion and Recommendations

In general, as the current data shows Ethiopia had imported 10226.23 kg of rennet in net weight within the last ten years 2007 to 2016 and had spent 1,843,749.09 ETB or 107,007.6597 USD to import this volume. The products origin were ten different counties, China, Belgium, Germany, Switzerland, Netherland, France, Denmark, Italy, India, Egypt, United Kingdom and South Africa. Similarly, Ethiopia had imported around 33, 7119 Kg dairy machinery in net weight from 22 countries and had spent 110,340,118 Ethiopian birr to import this volume Dairy Machinery for the last ten years from 2007 to 2016. Finally, the trend of imported rennet and dairy machinery shows up and down condition. This need further study in relation to development of cheese production by local industry and trends of cheese importation from other country to the volume of imported enzyme rennet and other form of milk coagulant utilizations. Therefore,

a) Ethiopia should invest on commercial coagulant enzymes

producing industry development to save the foreign currency

that is spent to import this product.

b) Ethiopia shall invest on general dairy machineries and

equipment industry to produce and save the foreign currency.

This is not only saving it can be future income generation by

exporting the product to other countries in the long run.

c) Research, Development, and Innovation work should

have to undergone by concerned stockholders and institutions

focusing on product development, on milk coagulants enzymes

as import substitution.

Acknowledgment

The authors would like to thank Ethiopian Meat and Dairy Industry Development Institute and staff of dairy department.

References

- Tegegne A, Gebremedhin B, Hoekstra D, Belay B, Mekasha Y (2013) Smallholder dairy production and marketing systems in Ethiopia: IPMS experiences and opportunities for market-oriented development. IPMS, Nairobi, Kenya, ILRI Working Paper 31.

- Eyassu S, Doluschitz R (2014) Analysis of the dairy value chain: Challenges and opportunities for dairy development in Dire Dawa, Eastern Ethiopia. International Journal of Agricultural Policy and Research 2(6): 224-233

- Azage T (2008) Why Ethiopia’s dairy industry cannot meet growing demand for milk.

- Bingi S, Tondel F (2015) Recent developments in the dairy sector in Eastern Africa Towards a regional policy framework for value chain development. European Center for Development Policy Management.

- Brandsma W, Mengistu D, Kassa B, Yohannes, der Lee J (2013) The Major Ethiopian Milk sheds an assessment of development potential. Wageningen University and Research center Livestock Research.

- Land OLakes (2010) The Next Stage in Dairy Development for Ethiopia dairy Value Chains, end Markets and Food Security.

- Asfaw N, Shahidur R, Berhanu G (2005) Livestock Production and Marketing. Ethiopia Strategy Support Program II (ESSP II).

- Khan M, Selamoglu Z (2020) Use of Enzymes in Dairy Industry: A Review of Current Progress. Archives of Razi Institute 75(1): 131-136.

- Sara E, Mitiku E, Zelalem Y, Binyam K (2016) Strength and Keeping Quality of Abomasum Rennet and its Influence on Yield and Quality of Halloumi Cheese made from Cow Milk. East African Journal of Sciences 10(1): 41-48.

- Çepoğlu F, Güler Akın MB (2013) Effects of coagulating enzyme types (commercial calf rennet, Aspergillus niger var. awamori as recombinant chymosin and rhizomucor miehei as microbial rennet) on the chemical and sensory characteristics of white pickled cheese. African Journal of Biotechnology 12(37): 5588-5594.

- Beux S, Pereira EA, Cassandro M, Nogueira A, Waszczynskyj NN (2017) Milk coagulation properties and methods of detection. Ciência Rural Santa Maria 47: 10.

- Amal BA, Souhail B, Hamadi A, Christophe B (2017) Milk-clotting properties of plant rennets and their enzymatic, rheological, and sensory role in cheese making: A review International Journal of Food Properties 44

(supp 1). - Kumar P, Sharma N, Ranjan R, Kumar S, Bhat ZF (2012) Perspective of Membrane Technology in Dairy Industry: A Review, Asian Austr J Anim Scie 26(9): 1347-1358.

- Douglas GH (2019) Handbook of Agricultural and Farm Machinery. 3rd

- Persistence Market Research (PMR) Most In-Demand Global Market Research Study that Drives Profitable Growth.

- Sonal Singh KA (2018) Global Market Insights.

- Food Processing Suppliers Association (FPSA) (2019) Dairy Processing Equipment Market - Global Forecast to 2023.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...