Lupine Publishers Group

Lupine Publishers

Menu

Review ArticleOpen Access

Energy Market Liberalization, Electricity Shortage, Subsequent Challenges and Renewable (Solar) Energy’s Role Volume 1 - Issue 3

Maia Melikidze1*, Garik Teymurazyan1, Eka Okromelidze2 and Ana Kashia3

- 1Renewable Energy Sources Laboratory, Stanford university, Georgia

- 2Renewable Energy Sources Laboratory, Stanford university, Georgia

- 3Renewable Energy Sources Laboratory, Stanford university, Georgia

Received: October 09, 2020 Published: November 16, 2020

Corresponding author: Maia Melikidze, Associated Professor at Business and Technology University, Commissioner at Georgian Energy Regulatory Authority, Stanford univercity, Georgia

DOI: 10.32474/JBRS.2020.01.000111

Abstract

The research paper attempts to explore the ways to develop a state strategy for renewable energies and establish preferential

systems. The study results are based on the Desk Study methodology. The paper uses the quantitative method through statistical

data gathered from reliable sources such as state agencies and publicly accessible official sources.

The international experience on the topic has been well-researched and the necessary components needed to rehabilitate the

global energy industry in the post-pandemic period have been identified. The general list of literature includes scholarly articles

from international peer-reviewed publications, legislative and sub-legislative acts of the country, strategic documents, results of

international relevant research, and information requested from state agencies.

Keywords: Renewable energy; Energy market; Electricity shortage; Net Metering

Introduction

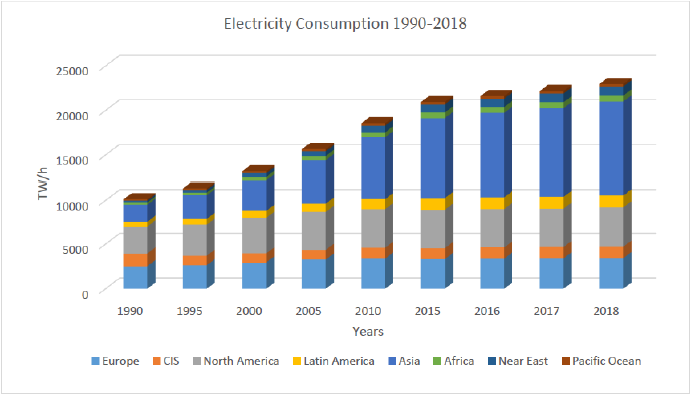

In the digital age, a world without technology seems very difficult to imagine. The ongoing process of technology development makes devices more compact that dramatically increases the demand for high-quality electric power. Consequently, energy consumption demand is on a rise and the trend is expected to be upward. In comparison with 1990, the global energy consumption has doubled (Table 1).

Electricity Consumption Trend 1990-2018

Europe / CIS / North America / Latin America

Asia / Africa / The Middle East / The Pacific Ocean

As the diagram depicts, global demand for energy is increasing

rapidly each year [1], and Georgia is not an exception. In the 1990s

the bulk of total energy was consumed by North America which was

later outstripped by Asia consuming 2.32 times more electricity

according to the 2018 statistics. The similar marked increase can

also be observed in Latin America, Africa and the Middle East.

The aim of the research is to identify the challenges facing

Georgia’s energy sector, explore ways to respond to them,

determine the development opportunities in the field, and tackle

the issues related to the energy market liberalization [2]. Based on

the analysis of European experience, the paper attempts to define

the stakeholder collaborative system in new business ecosystem

and offer development prospects both for businesses and the state.

Results and Analysis

Balance and Solar Energy Potential

Georgia is characterized by almost every climate zone existing

on the earth, ranging from humid subtropical to eternal snow and

glacial zones [3]. Due to its relatively low latitude and moderate

cloudiness, Georgia receives significant warmth from the sun.The

average annual sunlight is 1,350-2,520 hours. (http://energy.gov.

ge/energy.php?id_pages=60&lang=geo)

According to the Galt & Taggart research report published on

October 3, 2019, electricity import increased by 20.5% in 2019 [4].

Azerbaijan was the main provider of import with 91.1% share in

total; the rest was imported from Russia. (https://galtandtaggart.

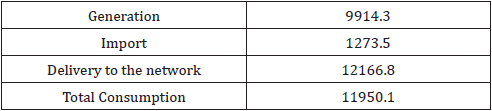

com/upload/reports/18281.pdf) (Table 2).

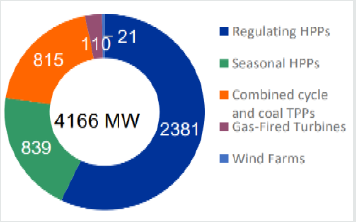

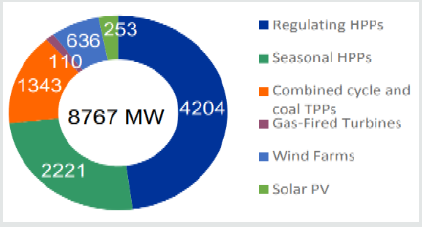

Currently, the installed capacity of the Georgian electric power system amounts to 4166 MW, of which 2381 MW is generated by regulated HPPs, 839 MW by ‘seasonal’ (run-of-river) HPPs, 110 MW by Gas Turbines, 21 MW by wind farms, and 925MW by thermal power plants and combined-cycle gas turbines (Fig.1). Roughly 77% of the total in-country installed capacity is provided by HPPs. It should be noted that by 2029 share of wind and solar power plants will reach 10% and its growth is expected to remain on a upward trend (Ten Year Network Development Plan of Georgia 2019-2029, p. 10). (Fig 1&2)

Figure 1: Installed capacities of the existing power plants Source: Ten Year Network Development Plan of Georgia 2019-2029, p.11)

Figure 2: Installed capacities of power plants as for 2029 Source: Ten Year Network Development Plan of Georgia 2019-2029, p.11)

According to ESCO data, electricity supply (million kWh) for eleven months of 2019 is as follows: the share of solar energy is quite limited [5]. However, this table shows the potential solar power plants and their possible maximum power output in the future.

The Role of the State and the Net Metering System

No significant state-level steps have been taken so far towards

the solar energy sector development. It is at the expense of

enthusiasts the field is evolving. It is noteworthy that in 2016 [6]

GNERC launched the Net Metering Regulation according to which

individuals can generate their own electricity and sell the excess

electricity to the operator. As of the end of 2019, 131 customers had

been connected to the system. It is significant that solar panels are

being installed in highland settlements of Georgia. On the report

of National Statistics Office of Georgia, in 2018, 128,6 TJ electricity

was generated, which represents 0.348% of the total production.

It is a well-established method for customers to meet their

consumption needs through utilizing micro-capacity renewable

energy sources, which are supported by various international

level incentive policies. According to the information available

to the GNERC Commission, by the end of 2018, through Telasi

JSC 27 subscribers had been participating in the net metering

system with total capacity of 358.15 kW, while 40 subscribers

through EnergoPro Georgia JSC with total capacity of 381.61 kW.

Overall, in 2018, 67 subscribers were participating in the net

metering [7] system with total capacity of 739.75kW. Compared

to the previous year, net metering in 2018 can be characterized

with the following indicators: there was a 2.4 fold increase in the

number of subscribers and the installed capacity grew 2.7 times.

Not only does the net metering program enable the customers to

generate increased amount of electricity for self-consumption, but

also supply the excessive electricity to the relevant distribution

network for the corresponding payment. 2018 was marked with

the intensive work of the Commission to elaborate and further

develop net metering regulation allowing a collective involvement

of the group of customers in the net metering program.

Solar power plant generation can be correlated with the

country’s overall consumption in order to reduce daytime peak

loads. On the other hand, when clouds pass over a solar power

installation, the efficiency of the latter can drop which will create

the need for additional high-capacity power reserves to offset the

solar generation instability [8]. In conjunction with solar power

plants, battery energy storage can be used to tackle this challenge.

With its optimal settings, these batteries can bolster the country’s

use of solar energy efficiency and provide optimal supply option

such as solar energy converters.

In recent years, the interest in wind and solar power plant

construction has increased dramatically. Hence, Georgian Electricity

Transmission System JSC ‘Georgian State Electro system’ with the

support of European consultants’ consortium DigSILENT-DMCCR2B

has studied the possibilities of integrating variable renewable

energy sources in the Georgian power system. The outcome of the

study reveals that, by 2020-2021(after implementation of balancing

mechanisms), [9]Georgian power system can integrate 333 MW

wind and 130MW solar power plant (25%of potential); (GNERC

Solar energy incentive mechanism – net metering, p.25, 2018)

Liberalization of the Energy Market and Its Accompanying Challenges

The global energy market liberalization process took place

around 30 years ago with the UK being one of the pioneers to revamp

its energy system, which nowadays is considered to be a standard

model for electricity liberalization worldwide. British model was

pursued by many countries and successfully implemented. In 2001,

Norway was first to offer a European power exchange Nord Pool

which is now owned by Euronext and the continental Nordic and

Baltic countries’ Transmission System Operators (TSOs). Nord Pool

delivers power trading across Europe.

Market liberalization is a process that accompanies a free market

economy. It is the process of lessening the burdens of government

control, lifting various barriers and deregulating established tariffs.

It is worth noting that the level of liberalization greatly depends

on the legislature which tightens or relaxes restrictions at its

discretion. Georgia is planning to fully liberalize its energy market

in 2021. Georgia became committed to these reforms once it joined

European Energy Community and has been actively involved in

the preparation process since 2017 to start full liberalization of

the market. Drawing upon the world energy market experience,

energy liberalization has a favorable impact on the efficient and

ecological functioning of stable, energy-efficient electricity system

[10]. The energy market liberalization will entail more transparent,

diversified energy system focusing on promoting greater energy

system efficiency. In order for Georgia to achieve this result, it is

important to have stable macroeconomic environment, attract

investments and adopt complex approaches towards electivity

supply companies.

The main accomplishment that the energy market liberalization

will bring about is freedom of choice. New companies will emerge

that will stimulate healthier competition and market regulated

prices. In addition, market liberalization will attract more foreign

players to invest which, in turn, will encompass increased electricity

production. Another outcome of the energy market liberali will be tariff change. One of the primary goals of the reform is to

create fair and healthy business environment; therefore, as implied

by free-market economy [11], tariffs will be set by the forces of

supply and demand. Hence, the new concept of ‘hourly pricing’

will be introduced to the Georgia’s electricity sector and the whole

population. The notion signifies that there is positive correlation

between energy consumption and tariff; this means when

consumption is high, tariffs grow correspondingly, and when it is

low (mostly during the night hours), price drops accordingly. The

abovementioned factors will boost foreign investment in energy

sector as the higher business income, the greater stimulus is has to

increase its production.

In the first stage of market liberalization, tariff hike is inevitable.

Due to its electricity generation deficit, Georgia greatly relies on

import. The situation can be further aggravated by volatile national

currency which tends to fluctuate continually. The regulation

strategy will develop a competitive market; however, the factors

that hinder the process are the existence of supply and distribution

monopoly. Retail customers are deprived of a chance to change

their suppliers based on quality, price or other inadmissibility. [12]

In December 2019, the Parliament of Georgian made an initial step

forward by passing a relevant legislation as a result of which the

Energy Exchange was established by the Georgian Government.

The primary aim of the Energy exchange is to ensure the process

of energy transfer, delivery and distribution so that the consumers

can be entitled to choice and create ample opportunities as well

as desire for other companies to operate. Therefore, [13] the state

needs to adopt a new approach which will reduce government

intervention and allow all stakeholders trade at real market prices.

The liberalized energy platform will encompass two markets:

Day-Ahead Market (DAM) and Intra-Day Market (IDM), where the

latter supplements the first one and helps to keep demand and

supply in balance. Single price coupling algorithm EUPHEMIA

(acronym of Pan-European Hybrid Electricity Market Integration

Algorithm) was developed in Europe to calculate [14] dayahead

electricity prices across Europe and allocate cross border

transmission capacity on a day-ahead basis.

Georgia’s emerging market economy which is still in the

process of formation is frown upon by some who strongly and

openly oppose its way of development. Their concerns are fueled

by unstable political environment and inconsistent legislature

that pose the treat to the country. This so-called ‘transition

economy’ is the period when a country undergoes a process of

market liberalization during which any change in legislature and

its political will can put investors in vulnerable position and leave

them increasingly exposed. [15] Furthermore, there is a possible

threat posed by cartel deals that can roughly intervene in the

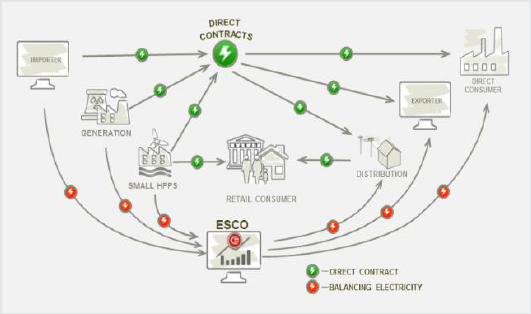

emergence of energy resources’ market value. (Fig 3)

Importer / Direct Contracts / Direct Consumer

Small HPPS / Retail Consumer / Distribution/

Direct Contract / Balancing Electricity

As mentioned above, by establishing Energy Exchange that

is planned to launch its operation in 2021, Georgia has moved

one step closer to energy liberalization; and in cooperation with

Electricity System Commercial Operator (ESCO), it will ensure

energy sector development and power sustainability. Energy

trading is expected to be conducted by financial instruments, [16]

such as energy derivatives, that will provide a considerable impetus not only towards the energy sector but also towards Georgia’s

Financial Exchange. On its part, the development of the financial

market ensures foreign investment inflow that entails capital

market accessibility for local businesses.

ESCO will serve as a guarantor to have all the duties and

obligations met. Customers are entitled to choose own suppliers

and individually agree on tariff and delivery terms. [17] This will

contribute to a healthier competition and market diversification.

Conclusion

Renewable energy development is primarily the main

determinant of environmental and economic upswing. For our

country, eliminating heavy reliance upon foreign oil and imported

energy remains the major challenge; thus, gaining energy

independence can lead to more stable environment.

After signing the Association Agreement with the European

Union, Georgia has made commitments in the energy sector which is

in need of systematic reforms. Due to the significance of renewable

energy development, the government expresses its readiness to

counter the existing challenges in the energy sector.

Of vital importance is for the state to provide economic

stimulus targeting at increasing ‘Green Energy’ demand and

provide effective mechanisms that facilitate renewable energy

generation. Relevant and effective legislation will contribute to

more secure environment for investors. Furthermore, conducting

researches and collecting data together with mapping out viable

long-term strategies and development schemes will induce more

active involvement of stakeholders.

References

- Bochorishvili, E, &Chakhvashvili M. (2019) Electricity Market Watch (brief overview),

- Change Measures in Georgia – Policy Indicators.

- (2019) Energy Exchange Established in Georgia.

- (2017) Electricity Market Liberalization, prospects and challenges.

- (2016) Euphemia Public Description PRC Market Coupling Algorithm.

- GNERC Solar Energy Incentives – Net Metering, (2018); Ten Year Network development Plan of Georgia 2019-2029; transmission System Operator JSC ‘Georgian State ecosystem’.

- (2017) How the European day-ahead electricity market works. ELEC0018-1 - Marche de l'energie Pr. D. Ernst Bertrand Cornelusse.

- (2017) International experience of Electricity Market Liberalization.

- Ksovreli T, Gogoladze M, Mokia K, Kinsturashvili M, Nonikashvili L, et al. (2019) Energy Balance of Georgia.

- Margvelashvili M (2015) Georgian Energy Sector in the Context of EU Association. World Experience for Georgia (WEG), Tbilisi, Georgia.

- Mukhigulashvili G, Kvaratskhelia T (2013) Renewable Energy Sources and Energy Efficiency. World Experience, Tbilisi, Georgia.

- (2020) Nord Pool Group.

- OECD (2018) Environmental Directorate. Mobilizing Financial Recourses for Climate.

- Tatarshvili, Zurabishvili N (2019) Natural Resources and Environmental Protection of Georgia. National Statistics Office of Georgia, Tbilisi, Georgia.

- (2019) The Electricity Market Operator, Electricity Balance.

- Tsurtsumia T, Janelidze S Energy Obligations Defined by the Georgia’s accession protocol to the Energy Community Treaty.

- World Energy Statistical Yearbook, Domestic Electricity Consumption.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...