Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2637-4676

Research Article(ISSN: 2637-4676)

Did E-commerce Increase Agriculture Firms’ Profitability During the COVID-19 Pandemic? Volume 10 - Issue 1

Annalisa Stacchini*

- Department of Economics, University of Bologna, Italy

Received: June 16, 2022; Published: July 19, 2022

Corresponding author: Department of Economics, University of Bologna, Italy

DOI: 10.32474/CIACR.2022.10.000328

Abstract

Almost all economic sectors suffered from the COVID-19 pandemic and many companies survived, or even increased profits, thanks to e-commerce. Agriculture, that tends to follow a traditional business model neglecting internet, reported notable losses in 2020. As always, not all the farms suffered to the same extent, so the goal of the empirical analysis presented in this study is to test whether owning a website from which the production could be sold directly helped firms making profits. Based on a sample of Italian firms located in Emilia Romagna region, no influence on profits of owning a website is detected, but the most important factor turns out to be the number of employees. However, this analysis is very limited and further research is needed.

Keywords: Elderberry;E-Commerce; COVID-19; Farms Profits; Emilia Romagna

Introduction and Background

The COVID-19 outbreak has drastically impacted citizens’ daily life, business and economics, especially in the countries most seriously hit by the pandemic, like Italy [1]. Lockdowns, mobility restrictions, social distancing and prohibition of gatherings prevented or significantly limited most social activities [2]. as well as offline shopping [3]. As a consequence, people spent more time surfing the web and e-commerce took to the skies [4]. According to Andrienko (2020), the best-online-selling products were toilet paper, disposable gloves, little domestic appliances, equipment for practicing sport at home and pastimes. With reference to the food industry, home delivery services thrived and new websites dedicated to this activity were opened [5]. E-commerce represented a vital opportunity, for most companies, to continue to make revenues when their traditional business model was forbidden or unfeasible, and so to survive or even increase their profitability. However, there is room to wonder whether also firms in the agriculture sector, maybe the most traditional and unfamiliar with ICT one, took profit from such opportunity.

It might be unexpected, as they produce primary and indispensable goods, but farmers too encountered many problems during the pandemic. Restriction to mobility and extensive quarantines hindered harvesting and products transportation [6]. Farmers’ income decreased concerningly and, according to[7]. in China 16 million employees lost their job in the agriculture industry. Based on the survey by [8], sales were the business operations most seriously affected by the pandemic in Chinese farming companies, half interviewees lost more than 30% sales volume and, on average, the income loss was about 40%. The authors found that just a few largescale producers relieved to some extent the negative effects of the pandemic by developing e-commerce, thanks to the availability of the required skills. The latter are likely to lack in smaller farms, circumstance that might explain why they did not already implement such activity, though they are interested in starting it [9]. considering that e-commerce should lead to costs reduction and increased profitability [10]. However, to the best of my knowledge, so far, it has not been empirically verified whether e-commerce did actually help farmers doing profits during the worst year of the pandemic. With the objective of starting to shed some light on this issue, this work presents an analysis of 895 Italian farming companies from the Emilia Romagna (NUTS 2 area, 1 of the 20 administrative regions).

Materials and Methods

With reference to 2010 [11]. The 73,466 farming firms in Emilia Romagna represented just the 4.3% of the Italian total, but, with an overall Utilized Agricultural Area (UAA) of 1,064,214 hectares, they constituted the 8,3% of the whole Italian UAA. Most of the land is dedicated to the cultivation of cereals, vegetables and alternate forage. The sector has undergone a progressive concentration process in this area. The companies that in 2010 used ICT for business activities the 9.6%, in line with the value of the northern Italian regions and well above the national average (3.8%).

In order to empirically test whether e-commerce did actually sustained farmers’ profits in 2020, when the pandemic hit very strongly the Peninsula, balance sheet data of 895 farming companies from Emilia Romagna have been retrieved from AIDA (Analisi Informatizzata Delle Aziende – Computerized Analysis Of Companies) by Bureau van Dijk. 213 firms have been selected randomly from those available with non-missing data for the main aggregates and a website on which is possible to buy their products, the rest have been chosen randomly from those available with non-missing data and without website. The following linear regression has been estimated with R statistics:

Net Income= β^’ X+ε ε~N(0,σ^2 ) (1)

Where the matrix X contains the variables expected to explain the net income: the number of employees (proxy for the dimension of the firm); the debt-equity ratio (representing financial solidity); the ratio of productions costs over the value of production (measuring the cost-efficiency); a dummy variable for each province (NUTS 3) where companies are located; a binary variable equal to 1 if the firm own a website from which its products can be purchased and 0 otherwise. All the variables, except for the dichotomous ones, have been standardize, because their scales were very different and this way the interpretation of the magnitude of estimated regression coefficients is straightforward. Then, by testing the statistical significance of the regression coefficient corresponding to the indicator of owning a website, the following research hypothesis is verified:

H1: farming companies that offer products on own website attain higher profits than those which do not recur to e-commerce (directly).

Results and Discussion

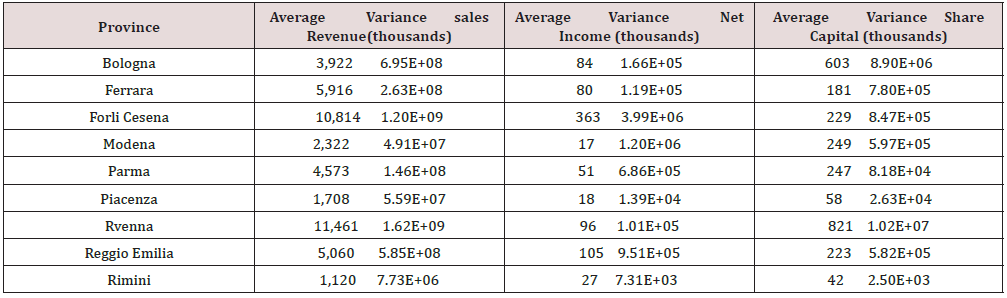

Descriptive statistics of the analyzed sample are reported in Table 1 below. The lowest average sales revenue was recorded in Rimini, mass beach tourism destination with residual rural areas in the hinterland, the highest one in Ravenna, historical Byzantine capital in the southern Po Valley. In Forlì Cesena, second province for mean revenue from sales, the by far highest mean net income was observed, while Rimini is the only province where, in 2020, farms reported losses on average. It is worthy of note that Rimini underwent the longest lockdown, possibly due to its proximity to the Republic of San Marino, that was particularly affected by COVID- 19 and recorded the highest mortality rate in the world (see: Our World in Data, 2022). Rimini is also the province with the lowest average share capital, while Ravenna shows the highest mean for this variable.

Figure 1 below displays a map with the average number of employees by province. Farming companies in both Rimini and Piacenza have just 5 workers, on average, while in Ravenna the mean is 44, and in Forlì-Cesena 42. Descriptive statistics for this dimensional indicator are consistent with those for sales revenue, as expected.

Figure 2 shows the percentage of sampled companies owning a website, by province. Reggio Emilia is ranked first also in this regard, with more than a third of farms giving the opportunity to purchase products from their own website. Interestingly, in Rimini slightly less than a fourth of the observed firms own a website, that is a much grater proportion than one would expect if e-commerce were indeed linearly related to profits, considering that the lowest percentage, observed in Piacenza, is 12% and there the average profit is 18 thousand euros.

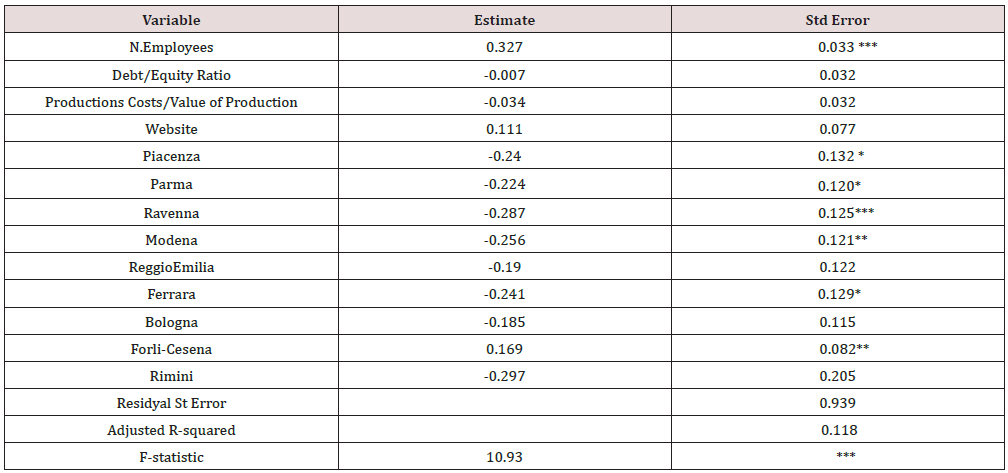

The regression output, displayed in Table 2, confirms that profits are not dependent on whether a farming company can sell its products on his website, because the corresponding coefficient is not significantly different from zero. Thus, research hypothesis H1 cannot be accepted with reference to the observed firms located in Emilia Romagna. This finding contrasts with the extant literature [5,10]. as well as with the expectations of farmers planning to develop e-commerce [9]. Maybe the Italian distribution system for agricultural products is too rigidly structured and subject to the overwhelming power of large-scale distributors, for profiting from direct e-commerce. But it is also possible that Italian consumers, a very old population, are not used to shop online, especially raw food which they might want to see, smell, touch in person.

The number of employees is highly significant and positively related to profit. Conversely, the other microeconomic variables do not influence profits linearly. Whereas, in most cases, the province where the farm is located represents an important factor of profit levels, as it might be expected, considering that the soil is the crucial productive asset in the agricultural sector [12]. As suggested by the provinces’ coefficients’, Forlì-Cesena may be endowed with the wealthiest natural resources for agriculture in Emilia Romagna or provide the most valuable public support to farmers, as companies located there, on average earn more than the others. Cultivating in Rimini, Bologna and Reggio Emilia does not make the difference, while farms in Ravenna might toil much harder than the others for generating profit. This evidence was unexpected, as Ravenna recorded the second highest average income. Overall, the model is significant, as shown by the F-test, but explains only 12% of the variability in profits. Thus, there are further variables, omitted from this study, that determinate the profit of farms in Emilia Romagna.

Concluding Remarks

This case study presented an empirical analysis of a sample of Italian farming companies located in the fertile Emilia Romagna region, aimed at testing if e-commerce actually helped farmers making profits in 2020, when the COVID-19 pandemic hit Italy with strong virulence. As opposite to the expectations built on the literature [5,10]. findings show that having a website from which consumers could purchase products directly does not influence farms’ profits, at least not linearly. However, this study is very limited, as it considered just an Italian region, employed only a few microeconomic variables and referred to a single year. Future research deepening the investigation by means of panel data and a more sophisticated model, including further variables more tightly related to the specificities of agriculture and spanning several years before and after the pandemic would be very interesting. Moreover, larger areas should be considered and the performances of farms in different countries compared, possibly adding also information from the demand side.

References

- Gossling S, Scott D, Hall CM (2020) Pandemics, Tourism and Global Change: A Rapid Assessment of COVID-19. Journal of Sustainable Tourism 29(1): 1-20.

- Miles L, Shipway R (2020) Exploring the COVID-19 pandemic as a catalyst for stimulating future research agendas for managing crises and disasters at international sport events. Event Management 24(4): 537-552.

- Bhatti AA, Akram H, Basit M, Khan A, Mahwish S, et al. (2020) E-commerce trends during COVID-19 Pandemic. International Journal of Future Generation Communication and Networking 13(2): 1449-1452.

- Jones K (2020) COVID-19 The Pandemic Economy: What are Shoppers Buying Online During.

- Xinjie GS, Guo H, Liu Y (2020) To buy or not buy food online: The impact of the COVID-19 epidemic on the adoption of e-commerce in China.

- Jiang HP, Yang DQ, Guo CR (2020) Impact of COVID-19 on China’s agricultural development and countermeasures. Reform 3: 5-13.

- Zhang Y, Diao X, Chen K Z, Robinson S, Fan S (2020) Impact of COVID-19 on China’s macroeconomy and agri-food system- an economy-wide multiplier model analysis. China Agricultural Economic Review 12(3).

- Gu Hy, Wang Cw (2020) Impacts of the COVID-19 pandemic on vegetable production and countermeasures from an agricultural insurance perspective. Journal of Integrative Agriculture 19(12): 2866-2876.

- Mastronardi L, Cavallo A, Romagnoli L (2022) How did Italian diversified farms tackle Covid-19 pandemic first wave challenges? Socio-Economic Planning Sciences 82(A): 101096.

- Elghannam A, Arroyo J, Eldesouky A, Mesias FJ (2018) A cross-cultural consumers’perspective on social media-based short food supply chains. British Food Journal 120(10): 2210-2221.

- ISTAT - Italian National Institute of Statistics. (2010). Censimento generale dell'agricoltura.

- Swaminathan MS, Bhavani RV (2013) Food production & availability-essential prerequisites for sustainable food security. The Indian journal of medical research 138(3): 383-391.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...