Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2637-4676

Research Article(ISSN: 2637-4676)

Comparative Net Returns for a Forage-Based Organic Crop Rotation Volume 9 - Issue 3

Michael Langemeier*1 and Michael O’Donnell2

- 1Department of Agricultural Economics, Purdue University West Lafayette, Indiana

- 2Organic Crop Consultant Muncie, Indiana

Received: May 21, 2021; Published: June 4, 2021

Corresponding author: Michael Langemeier, Department of Agricultural Economics, Purdue University West Lafayette, Indiana

DOI: 10.32474/CIACR.2021.09.000319

Abstract

This study compares the long-run net returns to land of a conventional corn/soybean rotation to that of an organic forage-based crop rotation that includes corn, soybeans, oats, and alfalfa. The average annual net returns to land for the organic crop rotation were found to be approximately $100 per acre higher than that of the conventional corn/soybean rotation. Average net return to land estimates are sensitive to crop price, crop yield, and cost assumptions. Holding crop yields and production costs constant, organic crop prices would need to be reduced 27 percent for the average net return to land to equal that of the average net return to land for the conventional corn/soybean crop rotation. A downside risk model was used to examine the tradeoff between expected net returns to land and risk. Converting even a small proportion of acreage to an organic forage-based crop rotation improved net returns to land and reduced downside risk compared to only utilizing the conventional corn/soybean crop rotation.

Keywords:Organic crops; net return to land; downside risk

Introduction

Previous research has shown the net returns for organic crop rotations to be higher than the net returns for conventional crop rotations [1-5]. Despite this, certified organic land accounts for less than 2 percent of U.S. farmland [6]. There are several challenges to converting crop land to organic production. Organic crop rotations tend to be of longer duration and are subject to change as soil conditions, marketing opportunities, and other factors change. These rotations also include small grains and legumes, and utilize cover crops to a greater extent [7]. In addition to being more complex, the profitability and riskiness of organic crop rotations depends on the transition period. During the transition period, a farm utilizes organic crop practices, but typically only receives conventional crop prices. Obviously, the transition period will impact potential net returns and the variability of net returns of the organic crop rotation. Most comparisons of relative profitability prospects for organic crop production compared to conventional crop production do not include the transition period in the comparisons. For example, McBride et al. [8] examined the profitability of conventional and organic corn, soybean, and wheat production using national survey data. Based on their analysis of USDA-ERS surveys, they found that significant economic net returns were possible from organic production of corn, soybeans, and wheat. The primary reason for the higher net returns were price premiums for organic crops. Crop yields were lower, and economic costs per unit were higher for the organic crops. Crop price, crop yield, cost, and net return data are also available by organic and conventional crop from the University of Minnesota FINBIN database [9]. Using FINBIN data from 2015 to 2019, organic crops tend to have lower crop yields, receive a higher price, and have higher costs per acre. Information pertaining to the crop rotations utilized and net returns earned during the transition period were not available for the comparisons made by McBride et al. [8] or in the FINBIN database [9].

Cox et al. [2] and Langemeier et al. [4] included an analysis of the transition period in their examinations of the relative profitability of organic and conventional crop rotations. Cox et al. [2] compared returns for organic crop rotations with various combinations of corn, soybeans, wheat, and red clover to conventional crop rotations with the same sequence of crops using experimental data from 2015 to 2018. The first two years of the study were designated as transition years. The net returns for the organic crop rotations during the four-year period were substantially higher. Langemeier et al. [4] compared the long-run net returns to land of conventional corn/soybean and corn/soybean/wheat rotations to that of an organic corn/soybean/wheat rotation. The organic crop rotation was found to have average annual net returns to land that were from $68 to $74 per acre higher than those for the conventional crop rotations. As noted above, organic crop rotations tend to be more complex than conventional crop rotations, often including small grains and/or legumes in the rotation. The small grains and legumes help control weeds, and the legumes provide nitrogen. An organic crop rotation with legumes makes sense in areas with a high demand for quality organic forages, such as locations with beef or dairy operations nearby.

The objective of this study is to compare the long-run net returns to land of a conventional corn/soybean rotation with a forage-based organic crop rotation. The organic crop rotation included corn, soybeans, oats, and alfalfa in a five-year rotation. Oats were planted with alfalfa in the first year, and were followed by two more years of alfalfa production. Corn and soybeans were planted in the fourth and fifth years. Oats and alfalfa were produced during the three-year transition period.

Materials And Methods

Enterprise Budgets

Rather than using a single year budget, to fully capture the importance of the transition period, ten-year enterprise budgets for each crop enterprise were developed so that we could compute net returns to land for each crop and crop rotation. Land was assumed to represent average productivity cropland for Indiana. Enterprise budgets developed included conventional corn, conventional soybeans, transition oats/alfalfa, transition alfalfa, organic corn, organic soybeans, organic oats, and organic alfalfa. Each enterprise was developed using projected crop prices, crop yields, government payments, and costs. Conventional corn and soybean enterprises were used to estimate net returns to land per acre for a corn/soybean crop rotation. Transition oats/alfalfa and transition alfalfa were used along with organic corn, soybeans, oats, and alfalfa to estimate net returns to land per acre for an organic crop rotation. The organic crop rotation was a five-year rotation: organic oats/alfalfa, organic alfalfa, organic alfalfa, organic corn, and organic soybeans. To ease weed pressure, the first organic crop was organic alfalfa. This organic crop was proceeded by transition oats/alfalfa and transition alfalfa. The transition of acres to organic production was assumed to take place over time rather than just the first three years of the ten-year period. Specifically, four fields were targeted for organic crop production. One-fourth of the fields were transitioned per year, resulting in a complete transition to organic crop production in year 6.

Crop price projections made by the Food and Agricultural Policy Research Institute [10] were used for conventional crops. The historical difference between conventional and organic crop prices, generated using FINBIN data [9] from 2015 to 2019, was used to estimate organic crop prices. Crop price projections for conventional crops were used for the transition crops. FINBIN data [9] from 2015 to 2019 were used to determine the relationship between conventional and organic crop yields in the first enterprise budget year. The yield drags for corn and soybeans were much larger than those for oats and alfalfa. The yield drags for corn and soybeans were 32.0 and 28.7 percent, respectively. The yield drag for oats was 8.2 percent and the yield drag for alfalfa was 10.1 percent. Because the transition crops utilized organic practices, the yields for the transition crops were assumed to be the same as those for the organic crops. Trend adjustments were used to increase crop yields for enterprise budget years 2 through 10. Gross revenue for each enterprise was computed using crop revenue (crop price multiplied by crop yield), government payments, and crop insurance indemnity payments. Most government payments are computed using base acres rather than crop acres, so farms that transition to organic production will continue to receive government payments. Crop insurance is available for both conventional and organic corn and soybeans.

Information in Langemeier et al. [11], FINBIN data [9], Klein et al., [12], and Chase et al. [13] were used to estimate costs for each crop enterprise. Both variable and fixed costs were included in the estimates. Variable costs included seed, fertilizer, manure, herbicide, insecticide, crop insurance, general farm insurance, repairs, fuel, drying cost, and operating interest. Fixed costs were comprised of depreciation and interest on machinery and equipment, and labor costs. The organic crop budgets recognized the substitution of manure, extra tillage operations, and additional labor for fertilizer, herbicide, and insecticide. In turn, variable costs were generally lower and fixed costs were generally higher for organic crops. To reflect what needs to take place for organic certification, the transition budgets use the cost estimates for the organic crops. More detail pertaining to the layout of the crop enterprise budgets can be found on the Center for Commercial Agriculture website [14]. Gross revenue, variable cost, contribution margin, fixed costs, earnings, and net return to land were summarized for each crop rotation. The contribution margin was computed by subtracting variable costs from gross revenue, which includes crop revenue, government payments, and crop insurance indemnity payments [11]. Earnings were computed by subtracting variable and fixed costs from gross revenue [11]. Earnings is a measure of economic profit (i.e., it accounts for all cash and opportunity costs). Net return to land was computed by adding land costs for owned and rented land to earnings.

Breakeven Price Analysis

To examine breakeven prices for the organic crop rotation and to utilize the downside risk model described below, annual gross revenue, variable cost, contribution margin, fixed cost, earnings, and net return to land during the ten-year period were discounted using net present value analysis. Net present value represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A discount rate of six percent was utilized in the net present value computations. Three scenarios were utilized in the breakeven analysis. The first scenario determined what the organic crop prices for each crop would need to be for the discounted net return to land for the organic crop rotation to equal that of the conventional corn/ soybean crop rotation. This scenario is quite pessimistic with regard to alfalfa prices. To reflect this fact, we examined two additional scenarios. The second scenario determined the breakeven organic crop prices assuming that organic alfalfa prices were equal to those assumed in the base case for organic alfalfa. The third scenario was the same as the second scenario except organic alfalfa prices were assumed to be the same as those for transition alfalfa in the base case. These scenarios illustrate how low organic crop prices could be before the organic crop rotation was less profitable than the conventional corn/soybean crop rotation. Also, as Singerman et al. [15] noted, the price determination of organic crops is independent from that of conventional crops, making it important to examine the sensitivity of organic crop rotation profitability to changes in organic crop prices.

Downside Risk Model

There are several methods that can be used to measure risk. Stochastic dominance can be used to make pair-wise comparisons between specific crop enterprises or crop rotations. For example, Delbridge et al. [3] used stochastic dominance to examine the cumulative density functions of organic and conventional cropping systems in Minnesota. Portfolio models can be used to examine the tradeoff between risk and return of various crop enterprises and crop rotation combinations. These models focus on combinations of crop enterprises and rotations, rather than making pair-wise choices. Given the transitional nature of organic crop production as well as the risk associated with the transition period, a portfolio model that examines the risk and return tradeoff of various adoption levels of organic crop production is used in this study. Variability and downside risk are commonly used to measure risk in portfolio models [16]. Variability focuses on dispersion from the mean, whereas downside risk focuses on low outcomes. To account for potential low net returns during the transition years, downside risk was the focus in this study. Specifically, expected net returns to land and risk for the organic and conventional crop rotations as well as combinations of these crop rotations were examined using the Target MOTAD model, which is commonly used model to examine downside risk. The Target MOTAD model maximizes expected net return subject to a constraint or limit on the total negative deviations measured from a fixed target or target income [17,18]. The Target MOTAD model focuses on the downside risk that occurs when the net return falls below a target level or net return. As with other portfolio models, tradeoffs between risk, as measured by total negative deviations below a target net return to land, and expected net returns to land are examined. To compute total negative deviations below the target, net returns to land for each crop rotation in each year are compared to the target net return to land. A negative deviation occurs when net returns to land for a given year are lower than the target. These annual deviations are then summed for each crop rotation to obtain the total negative deviations below the target net return to land.

The solution of the Target MOTAD model that identifies the maximum expected net return to land also has the highest level of total negative deviations below the target net return. In other words, this is the profit-maximizing solution. As the total negative deviations below the target net return to land is allowed to increase (i.e., become more constrained), risk and expected net return to land decline. A target net return to land of $171 per acre, which is the average annual net present value of cash rent, is used for the analysis in this study. Rather than examining a risk and return frontier (illustrates the entire range of risk and return), the downside risk model is used to compare risk and return for the conventional crop rotation, the organic crop rotation, the minimum risk solution, and three levels of partial adoption of the organic crop rotation. Specifically, adoption levels of 10 percent, 20 percent, and 30 percent are used. These partial adoption levels mimic how some farms transition to an organic crop rotation. A portion of total acreage is converted to allow the farm to experiment with and learn the organic crop rotation system. The minimum risk solution represents the combination of crop rotations that maximize net returns for the minimum level of risk that can be obtained with the downside risk model.

Results

Net Returns per Acre and Breakeven Prices and Yields

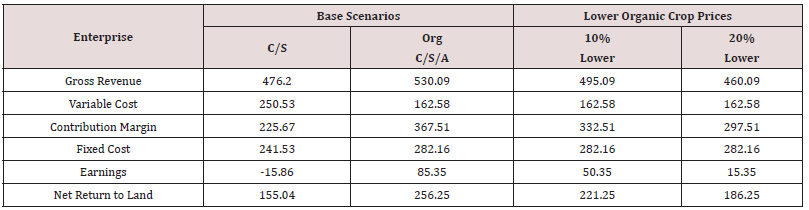

Average annual gross revenue, variable cost, contribution margin, fixed cost, earnings, and net returns to land per acre for the conventional and organic crop rotations are presented in Table 1. The gross revenue for the organic crop rotation was significantly higher than the gross revenue for the conventional corn/soybean crop rotation. Variable cost per acre was relatively lower for the organic crop rotation, but fixed costs were relatively higher. Essentially, the organic crop rotation substitutes manure and machinery costs for fertilizer, herbicide, and insecticide costs. Labor costs were higher for the organic crop rotation. The average annual net return to land for the organic crop rotation was $256 per acre, or approximately $100 per acre higher than that of the conventional corn/soybean crop rotation. The third and fourth columns in table 1 illustrate what the gross revenue, variable cost, contribution margin, fixed cost, earnings, and net return to land for the organic crop rotation would be if organic crop prices were 10 percent or 20 percent lower than the crop prices used in the base scenario. If organic crop prices were 10 percent lower, net return to land for the organic crop rotation would be 13.7 percent less. A 20 percent decline in organic crop prices would result in a net return to land for the organic crop rotation that was 27.3 percent lower than the base scenario. It is important to note that even with organic crop prices that are 20 percent lower, the annual net return to land for the organic crop rotation is still $31 per acre higher than the net return to land for the conventional corn/soybean crop rotation.

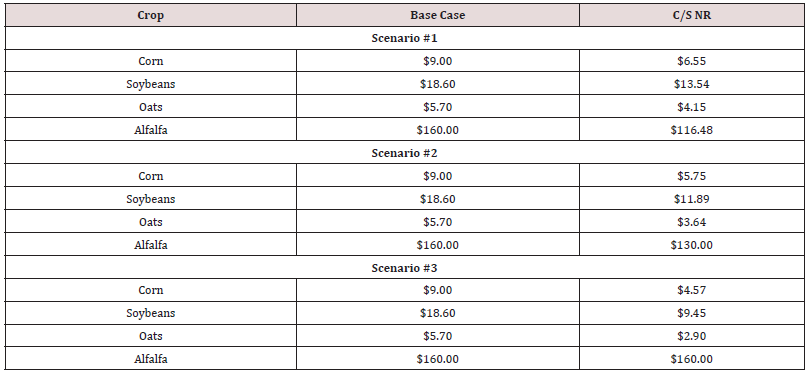

As noted in Table 1, average net returns to land are sensitive to changes in relative crop prices. To further explore the sensitivity of net return to land to changes in organic crop prices, breakeven organic crop prices were computed by equilibrating the net present value of net returns to land for the conventional and organic crop rotations under three organic crop price scenarios. The results are presented in Table 2. The first scenario in table 2 illustrates what the organic crop prices would need to be for the net returns to land for the organic crop rotation to equal that of the conventional corn/soybean crop rotation. As noted above, this scenario is quite pessimistic with regard to alfalfa prices. Holding crop yields and costs constant, organic crop prices would need to be reduced 27.2 percent for the average net return to land to equal that of the average net return for the conventional corn/soybean crop rotation. If the organic crop prices are changed while holding organic alfalfa prices at the conventional alfalfa price (second scenario in table 2), organic crop prices would need to drop 36.1 percent for the net returns to land for the two crop rotations to be the same. The third scenario uses the organic alfalfa prices while changing the other organic crop prices. Under this scenario, crop prices would need to drop 48.8 percent for the net returns for the two crop rotations to be the same.

Table 2: Breakeven Organic Crop Prices 1,2,3.

1 Corn, soybean, and oat prices are reported on per bushel basis and alfalfa is reported on a per ton basis.

2 The C/S NR column represents the price and yield needed to equilibrate net returns for conventional and organic crop rotations.

3 The three scenarios examine the sensitivity of results to alfalfa price assumptions

Tradeoff between Risk and Return

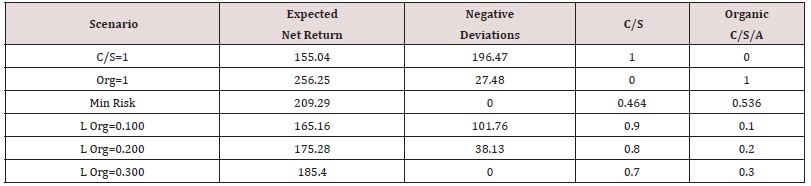

Table 3 illustrates expected net returns to land and risk for each crop rotation, the minimum risk solution, and for organic crop rotation adoption rates of 10, 20, and 30 percent. As noted above, with the Target MOTAD model, risk is measured using total negative deviations below a target return of $171 per acre. The organic crop rotation had a higher expected net return, and exhibited less risk than the conventional corn/soybean crop rotation. In fact, utilizing the organic crop rotation represents the profit maximizing solution. Utilizing a combination with 46.4 percent of the acreage planted to the organic crop rotation and 53.6 percent of the acreage planted to the conventional corn/soybean crop rotation minimized downside risk. The expected net return for this combination was $209, compared to an expected net return of $155 for the conventional corn/soybean crop rotation and $256 for the organic crop rotation. Note that downside risk is zero for the minimum risk solution. This means that net return to land for each of the years was higher than $171 per acre (i.e., there was no downside risk).

Table 3: Expected Net Return to Land and Total Negative Deviations below Target Income ($ per Acre).

Definitions: C = corn, S = soybean, A = alfalfa, CS = corn/soybean crop rotation, and ORG = organic crop rotation

Most farms that are transitioning to an organic crop rotation will only transition a portion of their acres at a given time so that they can learn the system and reduce risk. In addition, there may not be a large viable market for alfalfa hay in the region, which due to high transportation costs for hay, may limit hay production. To account for these facts, we illustrate scenarios in table 3 that allow for 10 percent (L Org = 0.100), 20 percent (L Org = 0.200), and 30 percent (L Org = 0.300) of a farm’s acres to transition to organic crop production. Comparisons will be made between these three organic crop rotation adoption rates and the conventional corn/ soybean crop rotation. An adoption rate of 10 percent, resulted in a $10 increase in expected net returns to land and a decrease in downside risk from 196 to 102, a 52 percent reduction. Adoption rates of 20 percent and 30 percent resulted in continued increases in expected net returns to land and large declines in downside risk. In fact, downside risk was equal to zero for the 30 percent adoption rate. The results for the three adoption rates in table 3 illustrate the benefits of adding an organic forage-based crop rotation to a conventional corn/soybean crop rotation.

Discussion

This study compared long-run net returns to land of conventional corn/soybean to that of a forage-based organic crop rotation. The average annual net returns to land for the organic crop rotation were found to be approximately $100 per acre higher than that of the conventional corn/soybean crop rotation. Breakeven organic crop prices were computed by comparing the net present value of net returns to land for the conventional and organic crop rotations. Crop prices would need to fall substantially for the average net return to land for the organic crop rotation to equal that of the conventional corn/soybean crop rotation. A downside risk model was used to examine expected net returns and downside risk for the two crop rotations and for three adoption rates for the organic crop rotation. Even transitioning a small portion of acreage to organic crop production was shown to dramatically reduce risk and increase expected net return to land. The enterprise budgets described in this study could be used by farms considering transitioning a portion of their acres to certified organic crop production. Producers considering this transition should carefully examine the sensitivity of net returns to alternative price, yield, and cost assumptions. In particular, the organic price premium over conventional crop prices changes over time, and thus has an important impact on relative net returns between conventional and organic cropping systems. It is also important to recognize that the crops grown, manure used, and tillage practices vary substantially among organic crop farms. It is also important to note that the adoption of a forage-based organic crop rotation hinges on the availability of regional hay markets. Farms without these markets may want to consider organic cropping systems that are not so dependent on hay production.

In general, farms have considerably more experience with producing conventional crops than they do producing organic crops. This may create challenges when transitioning a portion of their acres to organic production. FINBIN data [9] show a much wider difference in enterprise net returns among organic crop farms than their conventional counterparts [19]. This wider difference is likely due to the difficulty of managing an organic crop system, and the learning curve associated with growing organic crops. Thus, in addition to sensitivity analysis, potential organic crop growers should factor in a learning curve.

References

- Chase C, Delate , Hanlon O (2019) Economic Analysis of Two Iowa Crop Rotations, FFED 20. Ames, Iowa: Iowa State University Extension and Outreach, November.

- Cox W, Hanchar JJ, Cherney J, Sorrells M (2019) Economic Responses of Maize, Soybean, and Wheat in Three Rotations under Conventional and Organic Systems. Agronomy 9: 424.

- Delbridge TA, Coulter JA, King RP, Sheaffer CC, Wyse DL (2011) “Economic Performance of Long-Term Organic and Conventional Cropping Systems in Minnesota.” Agronomy Journal. 103(Issue 5,):1372-1382.

- Langemeier MR, Fang X, O’Donnell M (2020 )“Comparison of Long-Run Net Returns of Conventional and Organic Crop Rotations.” Sustainability 12(19): 1-7.

- White KE, Cavigelli MA, Conklin AE, Rasmann C (2019) Economic Performance of Long-Term Organic and Conventional Crop Rotations in the Mid- Atlantic. Agronomy Journal. 111(3): 1358-1370.

- 2017 U.S. Census of Agriculture (2020) United States Department of Agriculture, National Agricultural Statistics Service.

- Greene C, Hellerstein D (2020) Common Organic Practices Include Complex Rotations, Cover Crops, and Pasture. USDA-ERS: Washington,DC, USA.

- McBride WD, Greene C, Foreman L, and Ali M (2015) “The Profit Potential of Certified Organic Field Crop Production.” USDA-ERS: Washington, DC, USA.

- (2020) Center for Farm Financial Management, University of Minnesota. FINBIN web site.

- Food and Agricultural Policy Research Institute (FAPRI) (2020) Baseline Update for U.S. Agricultural Markets.

- Langemeier MR, Dobbins CL, Nielsen B, Vyn T, Casteel S (2021) Crop Cost and Return Guide. Department of Agricultural Economics, Purdue University: West Lafayette, Indiana, September 2020.

- Klein RN, Wilson RK, Grosskopf JT, Jansen JA (2017) Nebraska Crop Budgets, EC-872, University of Nebraska, Institute of Agriculture and Natural Resources: Lincoln, Nebraska.

- Chase C, Delate K, Johanns A (2009) Making the Transition from Conventional to Organic, Ag Decision Maker, A1-26, Iowa State University.

- Center for Commercial Agriculture, Purdue University (2020) Comparison of Conventional and Organic Crop Rotations web site.

- Singerman A, Lence SH, Kimble-Evans A (2014) How Related are the Prices of Organic and Conventional Corn and Soybeans? Agribusiness 30(3): 309-330.

- Hardaker JB, Huirne RBM, Anderson JR, Lien G (2004) Coping with Risk in Agriculture, Second Edition. CABI Publishing: Cambridge, MA, USA.

- Tauer L (1983) Target MOTAD American Journal of Agricultural Economics 65: 606-610.

- Watts MJ, Held LJ, Helmers GA (1984 ) A Comparison of Target MOTAD to MOTAD. Canadian Journal of Agricultural Economics 32: 175-186.

- Langemeier MR, O Donnell M (2020) “Conventional and Organic Enterprise Net Returns.” farmdoc daily (10): 161.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...