Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2643-6736

Research article(ISSN: 2643-6736)

Technical Economic Analysis of the Installation of A Photovoltaic System in the Municipality of Moa Volume 2 - Issue 5

Alvaro Laurencio Pérez1*, Igor R Pérez Maliuk2, Rodney Martínez Rojas3 and Luis Leandro Hernández Sánchez3

- 1Department of Electrical Engineering of the University of Moa, Cuba

- 2Holguín Electric Company, Cuba

- 3Department of Mechanical Engineering of the University of Moa, Cuba

Received: July 22, 2020; Published: July 29, 2020

Corresponding author: Alvaro Laurencio Pérez, Department of Electrical Engineering of the University of Moa, DrC Antonio Núñez Jiménez, Cuba

DOI: 10.32474/ARME.2020.02.000146

Abstract

In this work, an economic technical analysis of the implementation of a photovoltaic system to supply a group of 6 offices in the town of Moa is carried out. The study is carried out with the support of the calculation tool PVSyst and using the criteria Net Present Value, Internal Rate of Return and Recovery Period for the economic evaluation. The results indicated that the installation can generate 391,419MWh/a. The Net Present Value resulted from321423.54 USD, while the Internal Rate of Return was 14.64%, higher than the imposed rate of 12%. On the other hand, the Recovery Period of the investment was 6.09 years. The economic evaluation criteria indicate that the variant can be accepted, since it offers income during its useful life.

Keywords: Photovoltaic system; PVSyst; Net present value; Internal rate of return; Recovery period

Introduction

Photovoltaic systems installed on roofs are increasingly

common, since they not only stop occupying extensions that could

be part of some productive, cultural process, etc. But also guarantee

the supply of energy in the same place where it is consumed, which

contributes to the minimization of distribution losses. On the

other hand, several works demonstrate that in the region of the

Americas there is good potential for the exploitation of renewable

energy resources, specifically the exploitation of energy from the

Sun using photovoltaic systems [1-3]. In the country, the energy

context is directed to the development of renewable energy

sources, including photovoltaic solar energy. Within the guidelines

of the economic and social policy approved in the VI congress, the

Communist Party of Cuba refers to the use of alternative energy

sources in guideline 247, in which it is proposed to promote the

use of different renewable sources energy, prioritizing those that

have the greatest economic effect. This contributes to the fact that

several researchers are based on the potential of the country in

terms of the use of photovoltaic solar energy [4,5].

In order to comply with the country’s energy policy, the need

arises to carry out studies related to the issue of photovoltaic solar

energy in available spaces, in this case, taking advantage of the roof

of buildings.

The literature consulted on the subject is very varied. Some

authors consider the technical aspect in the dimensioning of the

installation, and that most of them rely on computational calculation

tools such as HOMER, RETScreen, PVSyst, among others, the latter

being one of the most widely used [5,6]. On the other hand, the

economic profit is based fundamentally on the criteria of the Net

Present Value (NPV) and the Recovery Period (PR) [6-8]. However,

the Internal Rate of Return (IRR) criterion allows us to know the

slack that exists with respect to the real value of the interest rate.

In this work, an economic technical analysis is carried out for the

installation of a photovoltaic system connected to the network, on

rooftops, in the town of Moa. The PVSyst calculation tool is used

to estimate the energy generated and the arrangement of panels. Likewise, the economic evaluation is based on the criteria of VAN,

TIR and PR.

Materials and Methods

Case study

The municipality of Moa is located in the northwest portion of the Holguín province with coordinates 20,390 North latitude and 74,560 West longitude. The location is proposed to be located on the roofs of 6 offices, for a total area of 1709m2, as shown in Figure 1.

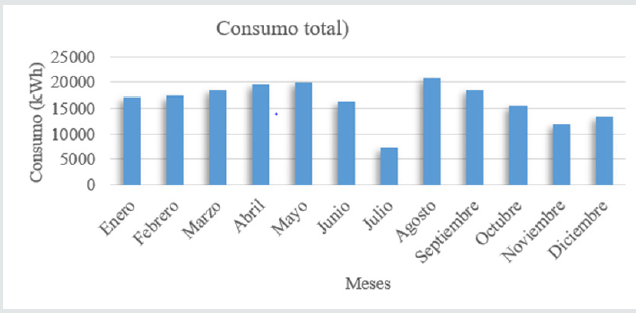

For the year 2019, the total consumption of the offices was 196.66MWh, distributed by months as shown in Figure 2.

Note that the months of greatest consumption are May and August, mainly associated with the local weather conditions and the continuity of work outside the working day.

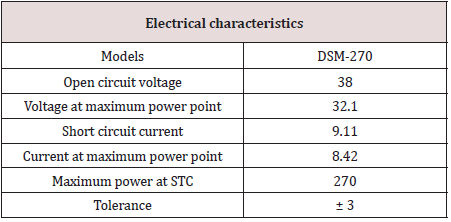

Photovoltaic modules

The study is carried out considering DSM-270 series modules manufactured in the Pinar del Río Province, which is made up of 60 solar cells of 156.75mm x 156.75mm format, connected in series. Its characteristics are shown in Table 1.

PVSyst software

The PVSyst software is a tool used to model the behavior of photovoltaic installations; enables the study, simulation and analysis of data from photovoltaic systems. With this software, facilities can be dimensioned, taking into account the solar radiation that it would receive depending on its location thanks to its meteorological database, and which takes into account the casting of shadows thanks to the simulation of the movement of the Sun during the day. This is one of the most widely used tools for energy evaluation studies of photovoltaic systems due to the relative simplicity with which it can be manipulated [5,6].

Economic evaluation

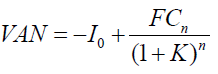

To perform the analysis from an economic point of view, the Net Present Value, Internal Rate of Return and Recovery Period are considered. The NPV measures in current money the degree of greater wealth that the investor will have in the future if he undertakes the project, so the result of the same must be positive in order for income to be generated [3,7,8]. Serving [8], the NPV can be calculated using the expression.

Where I0 is the initial investment, in USD, the FCn is the cash flow of the year n in USD and k is the discount or interest rate in percent.

The IRR method consists of an iteration process where two NPVs are searched, one positive and the other negative, whose values are as close to zero as possible. Once the positive and negative values have been found with their corresponding interest rate, the equation is applied (2), as proposed by [9].

Where kp and kn are the interest rates at which the positive and negative values are obtained, the NPV, respectively, expressed in percent. While VANp and VANn are the positive and negative Net Present Value, respectively in USD. The payback period marks the time, in years, that the project costs are supplemented by the benefits achieved, the mathematical equation of which is described in (3), considering constant cash flows.

Where FC is the annual cash flow, in USD.

Results

Arrangement of the whole and generated energy

For the simulation, an inclination angle of 180 is taken into account, the results of which determined that a total of 868 photovoltaic modules can be located in the 6 offices for an installed power of approximately 234.36 kW. In addition, a monthly load survey is carried out for each office and their total consumption is estimated. Figure 3 represents the total consumption of the premises, symbolized by the blue line and the energy produced by the plant, represented by the orange line, according to the results offered by the software.

Figure 2: Comparison of the energy produced by the plant and the consumption of the premises

Based on the results offered by the software, the energy generated per year is equivalent to 391,419 MWh.

Economic evaluation

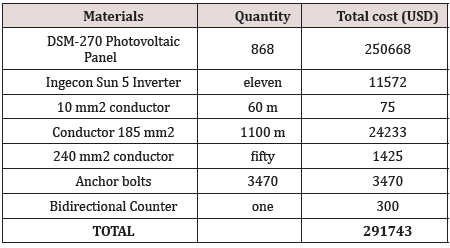

The economic evaluation is carried out based on the initial investment of the study, which considers the essential elements for the implementation of the photovoltaic system. Table 2 shows the elements considered in this investigation for the commissioning of the site.

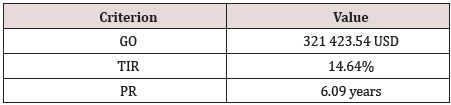

From Table 2 it follows that the initial investment is 807,743 USD. Taking into account that the energy generated by the installation is 391,419MWh/a, it generates cash flows equivalent to 58712.85USD/a, assuming an energy cost of 150USD/MWh generated. Table 3 shows the results obtained from the economic evaluation study.

To calculate the NPV, an interest rate of 12% is considered, used to study projects in the country. The VAN of 321423.54 indicates the income that could be obtained with the commissioning of the installation for the 25 years of its useful life that the manufacturer guarantees. On the other hand, the IRR of 14.64% is higher than the interest rate (12%) used in the study, so the work can be accepted. The time in which the investment is recovered is 6.09 years, a relatively short value compared to the 25-year life of the installation.

Conclusion

a) The installation guarantees an energy of 391,419MWh/a

per year with 868 connected modules.

b) The commissioning of the installation requires an initial

investment of 291,743 USD, which, taking into account the

economic results, recovers in approximately 6 years.

c) The economic evaluation criteria indicate that the variant

can be accepted, since it offers income during its useful life.

References

- David JM, Escobar AM, Hincapie R(2009) Description and analysis of the photovoltaic effect in the region. Scientia Et Technica.

- Ospino AJC (2010) Analysis of the solar energy potential in the Caribbean region for the design of a photovoltaic system. Inge-CUC 6.

- Rodríguez AKM, Cadena Á IM,Aristizábal AJC (2015) Design of photovoltaic solar energy systems for residential users in Chía, Cundinamarca 5: 55-65.

- Guzmán MV, Soto CRC (2017) Procedure for the installation of a photovoltaic system on roofs in the corporation Cuba SA. Sugar Center44.

- Osorio Laurencio L, Montero Laurencio R (2016) Energy analysis of a photovoltaic system integrated into a horizontal flat roof. Energy Engineering37(1): 45-54.

- García JEG, Sepúlveda SBM, Ferreira JJ (2018) Technical-economic viability of a photovoltaic system in a water treatment plant. INGE CUC14(1): 41-51.

- González CL, Torres J (2018) Economic technical study of solar panels interconnected to the distribution network. Iberoamerican Science Magazine5: 95-105.

- Salas YR, Gómez HB (2018) Technical and economic design of a photovoltaic solar test bench for the generation of electrical energy in isolation. Prospective16: 82-88.

- Taco D, Gutiérrez M (2018) Valuation of investments in unconventional projects-Internal rate of return versus internal rate of return modified. INNOVATIVE3: 126-133.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...