Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2643-6744

Research Article(ISSN: 2643-6744)

Self-Payment Fraud Detection on Automated Teller Machine Volume 1 - Issue 1

Mohammad Hossein Barkhordari*

- Information and Communication Technology Research Center, No. 5, Saeedi Alley, College Intersection, Iran

Received:September 22, 2018; Published:September 28, 2018

*Corresponding author: Mohammad Hossein Barkhordari, Information and Communication Technology Research Center, No. 5, Saeedi Alley, College Intersection, Iran

DOI: 10.32474/CTCSA.2018.01.000102

Abstract

Over the past decade the amount of transactions and reported frauds on Automated Teller Machines (ATM) has significantly increased. Various types of frauds have been reported around misusing ATM cards and many methods have been deployed to detect and prevent them. In some countries, banks sell ATMs to investors under predefined circumstances and pay them in commission in order to increase the availability of the service but some ATM owners have been found to create fake transactions to obtain extra commissions. This paper attempts to detect such frauds using a two-stage method. In the first stage fraudulent customers are detected by certain rules and in the second stage their accomplices are identified using transaction loop and cycle detection algorithm. Transactions of an Iranian bank have been used to evaluate the proposed method and all detected fraudsters by system were confirmed by bank fraud detection office.

Keywords: Fraud Detection; Cycle Detection; ATM Fraud Detection; Data warehouse

Introduction

Using credit and ATM cards for different purposes, such as buying services and products, has become one of prevalent methods in digital economy [1]. These cards help people buy anything without carrying cash and facing its risks. ATM cards also help buyers pay their product and service fees with minimum details of invoice. Effectively many customers use these cards instead of cash. Using ATMs for paying bills, transferring money, buying cell phone charges, viewing transactions list, and many other services causes customers to prefer doing their affairs without the need to be at bank, and banks benefit from these services through customer retention and higher cash flow. They can also use their human resources for other tasks and gain more productivity or alternatively reduce their staff to decrease their expenses. To increase customer satisfaction and liquidity, banks try to promote their services in cities. For this purpose they provide ATMs to investors under special conditions: if an investor can prepare required security and communication infrastructure banks allow them to buy ATM. The business model between bank and investors let banks to pay some percent of daily ATM transactions as commission to ATM owners.

Although ATM cards provide many advantages and services for customers and banks they are very susceptible to fraud. The significant number of ATM transactions compared to other payment methods has made them a worthy target for fraud [2]. This leads card issuers and beneficiaries to try to detect and confront ATM frauds. There are many methods proposed to detect frauds, which are presented in Figure 1. Due to Anderson classification on frauds there are eight classes of fraud [3]. In this classification ATM fraud is a subcategory in “Technologies ATM &Internet” category which can be further categorized into [4]

Physical Attacks

Attacker tries to move or damage ATM device physically.

Gaining ATM User’s Banking Information

There are many methods for gaining ATM users information. Attacker tries to attach illegal objects to ATM in order to capture card data and password, card password is stolen using different methods such as looking over the shoulders of ATM users and etc.

Financial Transactions Made by Inappropriate Methods or Users

Inappropriate methods or users consist of many items like using stolen cards by fraudsters and using forged notes in ATM environments, etc.

Self-Payment Attack

Unlike other mentioned types of fraud, which are related to a third party, frauds can also be conducted by ATM owners to obtain more commission. This is known as self-payment attack. Due to bank business model the more transaction amount ATM has, more commission is paid to its owner. This is the main reason for creating fake transactions by some ATM owners. In this paper a novel method is proposed to detect self-payment frauds on ATMs. In this method the fraudsters are identified using rules obtained by experts. Then transactional networks of these customers are built and by extracting loops in these networks, other users who collaborated in the fraud are extracted. Using this method in an Iranian bank many fraudsters were identified. The rest of the paper is organized as follows. In the next section, definitions and related studies are reviewed briefly. Then in section 3, the proposed method is described with details. Result of this proposed method on the practical data of Iranian bank transactions is presented and discussed in section 4. Finally, the conclusion and some other hints for future works are described in section 5.

Related Works and Definitions

In this section related studies about ATM fraud detection along cycle detection algorithm, which is used in this paper, are explained.

ATM Fraud Detection

Extensive research has been carried out to prevent these crimes, which can be divided into three categories [4]. Detection of physical damage on ATM, prevention of ATM banking user’s information and prevent financial transaction made by inappropriate users and methods. For detecting physical attacks motion sensors are used to detect the suspicion activities around ATMs [5]. Also, in [6] mentioned three ways to overcome physical attack of ATMs: the certification level of the ATM safe, using alarm and sensors to detect physical attacks and at last using ink stain technology that will mark and effectively make any removed money unusable. There are methods to detect illegal objects, such as cameras and card reproducers, attached to ATM [7]. Also, in [8] proposed a system to detect criminal objects attached to ATM like cameras that could read the users’ password. To prevent password theft in [9] diversifies password entering methods to avoid another people looking from behind of user. In [8] a system developed which warn user when loiterers are behind the customer. To detect and prevent financial transactions made by inappropriate methods or users there are methods such as card holder identification via biometrics [6,10,11], forged note detection in ATM environment [6,9] and recording facial images of ATM users [5,12,13].

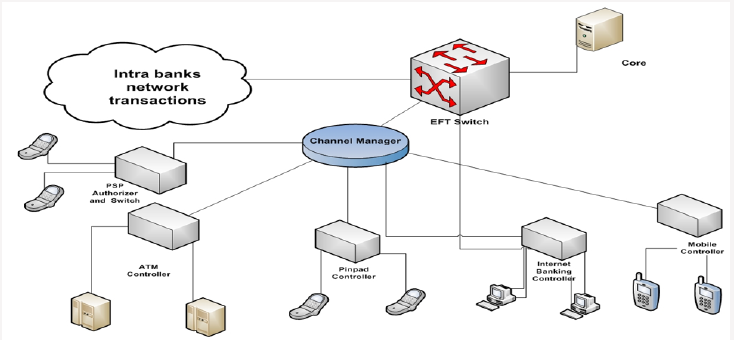

Eft Switch

Electronic banking architecture in many banks is as following Figure 2. The standard is used for financial transaction is ISO8583. This standard has three versions and they are related to 1987,1993 and 2003. Messages in this standard have 128 fields containing transaction information such as Amount, Date, Time, Device code, Function code, Process code etc. So, all devices on bank network have to be compatible with ISO8583 and they have to send and receive message with this format. For more information see [14]. As it is shown in Figure 3 each transaction is done by a device which is sent to its controller. After verifying message’s security and content, the transaction is sent to Channel manager. In addition to control payment channels this switch controls content and security of sent messages. After verifying messages by channel manager, they are sent to central EFT switch of bank. At central EFT switch if card is issued by other banks message is sent to Intra bank electronic message network, otherwise it is sent to Core banking system. The response is then provided to the customer.

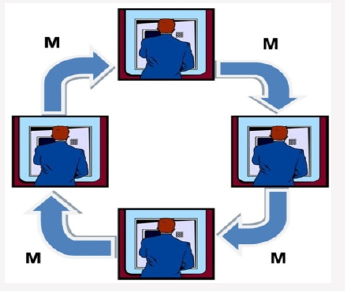

Self-Payment Fraud

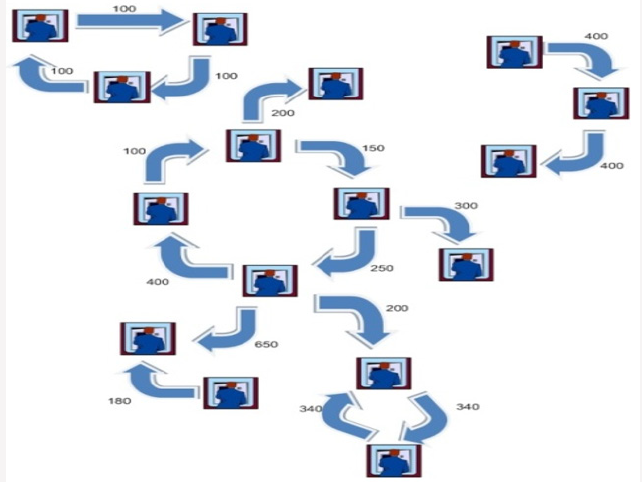

As mentioned before, some banks sell their ATMs to investors under predefined conditions. They pay some percent of transactions done by ATMs to the owner as commission. Unfortunately, some ATM owners make fake transactions for increasing their obtained profits, which is called self-payment fraud. For instance, suppose that there are four people with ATM card. First person transfer amount M to second person and second person transfers this amount to third person. Similarly, fourth person gets amount M from third person and finally transfer it to the first one. This way, four transactions with amount of M are done on the ATM for which the ATM owner obtains commission. Figure 2 depicts the elaborated process. This fake cycle could repeat many times and with shorter paths. Consequently, these transactions cost a lot in commission for the bank and also hinder them from their main goal and business model. Therefore, in this paper we focused on detect this type of frauds.

Proposed Method

In this part the proposed method for self-payment fraud detection is introduced. ATM’s transaction information is first sent to ATM controller and then they are sent to central bank switch. Information is periodically extracted from switch database of bank and ETL process is done on them. After this phase data warehouse is created. Due to high volume of bank transactions, using data warehouse increases fraud detection speed dramatically.

Phase I

In this part all EFT central switch data items need for future processes are extracted.

All transactions with ATM Device code are selected

From previous step transactions, all transactions with local transfer Function code are selected (As it was mentioned before fake transactions are created by local transfer)

All successful transactions are selected (transactions with response code=00)

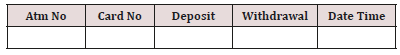

In this step we have transactions in ISO8583 format, so ATM No, Card No, Amount, Date and Time data items are selected.

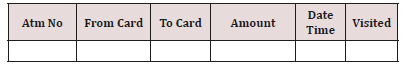

Selected items in previous step are transferred to a table with following format.

If money is transferred to card, “Deposit” field will be transferred amount and “Withdrawal” field will be 0 and if money is transferred from card, “Deposit” field will be 0 and “Withdrawal” field will be transferred amount.

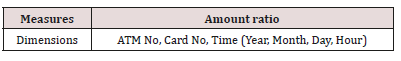

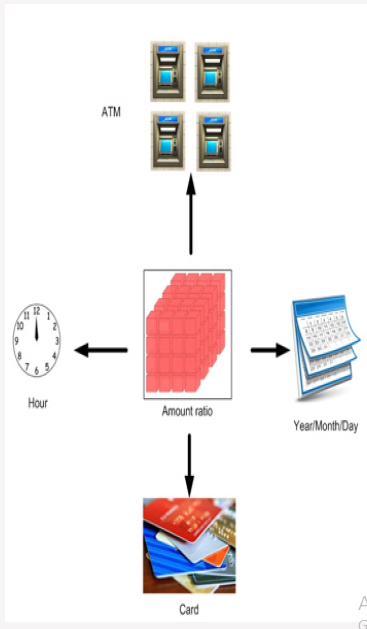

In this part data warehouse and cubes are created on Table 1. ATM No, Card No, Date and Time are considered as dimensions. Deposit and Withdrawal amount are considered as measures. Sum function is selected for data warehouse function. Also, a KPI is defined as Amount ratio (ϴ). The formula is defined as follow:

ϴ(Card No)=Deposit/Withdrawal

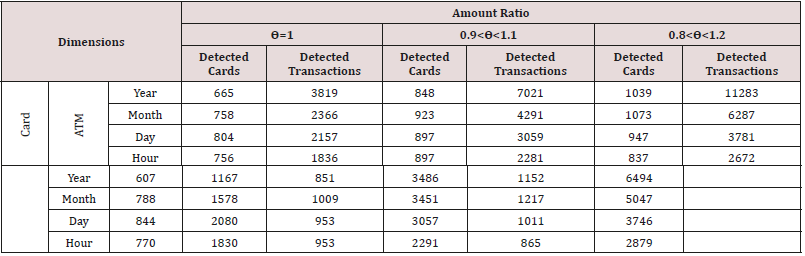

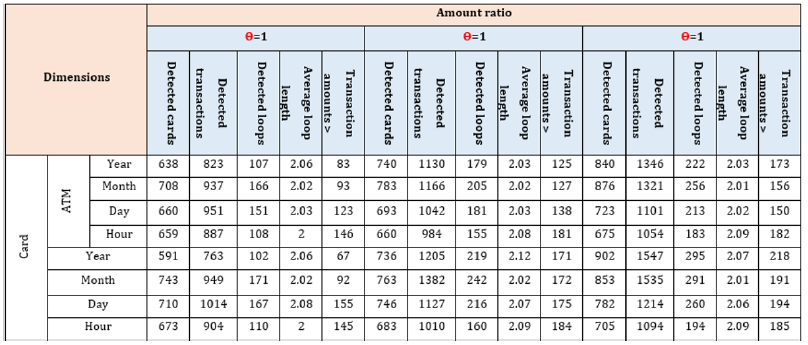

In this formula Deposit is the amount transferred to card and Withdrawal is the amount transferred from card. Amount ratio ϴ (Card No) shows Deposit / Withdrawal for a card. Table 2 shows information about Dimensions and Measures. Data warehouse general schema is shown in Figure 3. As demonstrated, Time dimension includes Year, Month, Day and Hour. This dimension is used for fraud detection in various time ranges and with different granularities. In this paper following rules are used for fraud detection. 1-Cards with ϴ=1, ϴ between 0.9 and 1.1 or ϴ between 0.8 and 1.2 have higher probability of creating fake transactions. The smaller granularity on a dimension and KPI, the higher the probability of fake transactions. For example, if a customer on an ATM in a day has equal deposits and withdrawals with a high probability he has committed self-payment fraud (Table 3).

2-Because it is possible the fraud takes place on two or more ATMs, ATM dimension is omitted and then investigation about Amount ratio is repeated again. Each of transactions meeting KPI thresholds is considered as a probable fake transaction. In this type of fraud, customers of multiple ATMs collaborate to create fake transactions on their ATMs. Above rules are extracted from experts’ knowledge. The customers who fall into the above category are considered to have most likely committed the fraud. These rules can detect suspicious customers. Customers extracted by this method with high probability really have committed fraud actions.

Phase II

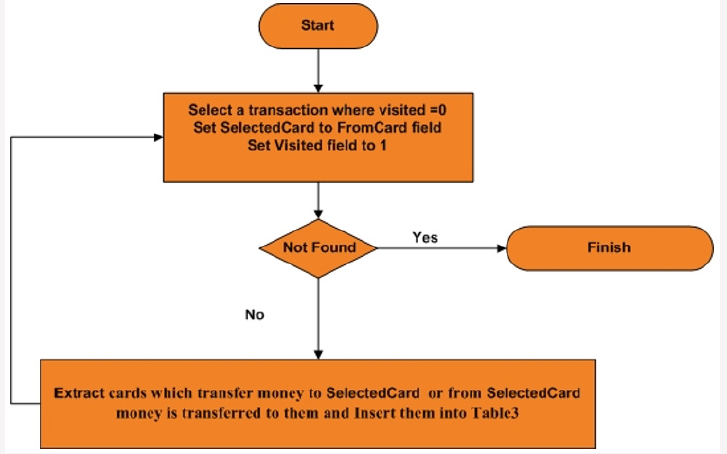

After extracting data items from central switch database, a restricted network is built with customer transactions. In previous section some customers who create fake transactions with high probability are discovered. But the point about this kind of fraud is that customers for doing this fraud need other customers. So, for finding other customers that are collaborating to create fake transactions more analysis is needed. As mentioned before, for increasing ATM amount operation, some customers transfer some amount of money to each other several times. With more analysis a loop is created between these customers. Result table format is as follow. Following algorithm is used for related card extraction.

First all cards that have relation with suspicious cards are extracted. These cards are those that transfer/receive money to/ from suspicious cards. So, all transactions which are related to these cards are extracted (Figure 4).

ϴ for extracted cards is calculated (as mentioned in Phase 1).

Transactions which have ϴ out of threshold range are omitted from transactions set.

Set Visited field for all transactions to 0.

Following Algorithm is used for Loop Detection

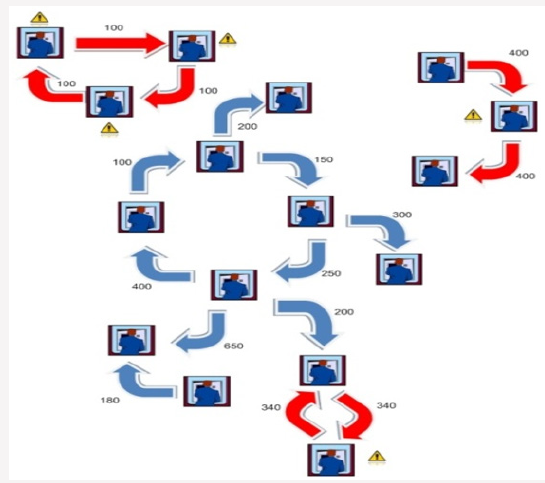

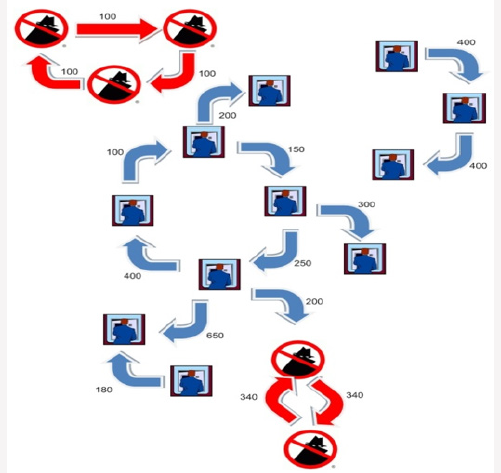

For more clarification an example is provided in Figures 5-9. Assume that there is a network of transactions. Figure 6 shows this network. Amount of transaction is on each edge. First phase of proposed method are executed on each node (card) and all nodes which have equal input and output are extracted(ϴ=1). These nodes are suspicious nodes. Figure 7 shows this phase. In this Figure 4 card holders are detected as suspicious. But as you see in Figure 7 not all of them are fraudsters. After detecting suspicious nodes, Phase 2 algorithm is executed on suspicious nodes. Detected loops are shown in Figure 8. As demonstrated some suspicous nodes from previous phase have been detected as normal behaviour. Two suspicious loops are detected in Figure 9. In addition to creating loop, all card holders which are in loop must have predefined range of amount ratio. In Figure 9 Amount ratio is equal to one. The detected customers can be introduced to bank fraud detection office for further investigations.

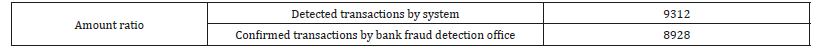

Results

To evaluate the proposed method, it is applied on transactions of an Iranian bank. For this purpose92702 local transfer transactions were investigated. Table 4 shows results of first phase of proposed method due to various dimensions (Card No, ATM, and Time). As it is illustrated in Table 4 using different periods for time dimension could affect the number of suspicious transactions. In Table 4 different ranges for ϴ is used. Due to these ranges and changing dimensions different card numbers and transactions are extracted. When ϴ range and Time dimension are bigger, more transactions and cards are extracted. But if ϴ range and Time dimensions are smaller fraud probability is higher. Because proposed method used database and data warehouse techniques, it has high performance for large amount of data like be Table 5 shows Phase II of proposed method results. As it can be seen in this table suspicious cards and related card are detected as it was described before. Then amount ratio filter applied on them. Finally loop detection phase is applied on cards. Table 5 shows detected cards, detected transactions, detected loops, average loop lengths and transactions which are bigger than 1000000 Rials. Detected cards certainly committed self-payment fraud. These cards, related ATMs, Date and Time were delivered to bank fraud detection office. They investigated transactions and loops and put some filters on these transactions. For example, if amount of a transaction in loop were smaller than 10000 Rials, these transactions were probably for system function test and were not fraud. Also, they decided if loop count for a specific card is bigger than one then this card committed self-payment fraud. With these two rules final results are as Table 6. Based on the amount of fake transactions some ATM owners had to pay penalty to the bank and for others the ATMs were seized.

Conclusion

In this paper we discussed self-payment fraud. Due to the nature of this fraud, all transactions should be investigated and fraud loops should be extracted. Two approaches were discussed in this paper. To the best of our knowledge there was no method for ATM owners’ fraud detection. Also, in this paper a method for loop detection is introduced that can be used for loop detection in many other systems. Proposed method extracts suspicious transactions in the first phase. Then related transactions are extracted in the second phase and all transactions are investigated again. Finally, it presents a list of fraudsters’ loops. Self-payment frauds are guaranteed in these loops. There is a problem with proposed method when all members of fraudsters loop have other transactions in addition to their fake transactions and amount sum of fake transactions by total transaction is lower than ϴ thresholds. For future work, proposed method can be used for link analysis in anti-money laundering. Also, it can be used for fraud detection on other payment channels like point of sale (POS) and fraud committed by their owners. Generally, proposed method loop detection can be used for all big data environments which need loop detection with some changes in details.

References

- Weiner S E (1999) Electronic payments in the US economy: An overview. Economic Review-Federal Reserve Bank of Kansas City 84(4): 53-64.

- Kou Y, Lu CT, Sirwongwattana S, Huang YP (2004) Survey of fraud detection techniques. In Networking, sensing and control IEEE international conference on 2: 749-754.

- Anderson, Raymond (2007) The Credit Scoring Toolkit: Theory and Practice for Retail Credit Risk Management and Decision Automation: Theory and Practice for Retail Credit Risk Management and Decision Automation. OUP Oxford.

- Jae Kyu Suhra, Sungmin Eumb (2012) Recognizability assessment of facial images for automated teller machine applications Pattern Recognition 45(2): 1899-1914.

- Y Tang, Z He, Y Chen, J Wu (2009) ATM intelligent surveillance based on omnidirectionalvision in: Proceedings of World Congress on Computer Scienceand Information Engineering pp. 660-664.

- Mohammed Lawan A (2010) On The Design of Secure ATM System. Cases on ICT Utilization, Practice and Solutions: Tools for Managing Day- To-Day Issues 213.

- H. Sako, T Watanabe, H Nagayoshi, T Kagehiro (2007) Self-defencetechnologiesfor automated teller machines in: Proceedings of International Machine Vision and Image Processing Conference pp. 177- 184.

- Sako, Hiroshi (2010) Technologies for developing an advanced intelligent ATM with self-defence capabilities. IS&T/SPIE Electronic Imaging. International Society for Optics and Photonics.

- CS Kim, MK Lee (2010) Secure and user friendly pin entry method in: Proceedingsof International Conference on Consumer Electronics pp. 203-204.

- H Sako, T Miyatake (2004) Image-recognition technologies towards advanced automated teller machines in: Proceedings of International Conference on Pattern Recognition pp. 282-285.

- M Negin, TA Chmielewski, M Salganicoff, UM Seelen, PL Venetainer, et al. (2000) An iris biometric system for public and personal use IEEE Computer Magazine 33(2): 70-75.

- L Duan, X Yu, Q Tian, Q Sun (2003) Face pose analysis from MPEG compressed video for surveillance applications in: Proceedings of International Conference on Information Technology: Research and Education pp. 549-553.

- G Kim, JK Suhr, HG Jung, J Kim (2010) Face occlusion detection by using b-splineactive contour and skin color information in: Proceedings of International Conference on Control, Automation, Robotics and Vision pp. 627-632.

- http://www.iso.org/iso/iso_catalogue/catalogue_tc/catalogue_detail. htm

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...