Lupine Publishers Group

Lupine Publishers

Menu

ISSN: 2637-4609

Review Article(ISSN: 2637-4609)

Value Chain Analysis for Medicinal Plant based products in India: Case Study of Uttarakhand Volume 4 - Issue 1

Tanya Chhabra*

- Natural Resources & Sustainable Development Department, Amity University, India

Received: December 12, 2018; Published: December 19, 2018

*Corresponding author:Tanya Chhabra, Natural Resources & Sustainable Development Department, Amity University, Noida, India

DOI: 10.32474/AOICS.2018.03.000176

Abstract

Value chain concepts and approaches can be used to understand the integration of producers of high value products in developing countries with regional and global markets. A value chain is a description of range of activities that involves processes of production, delivery and final disposal of the product after use. The value chain analysis involves the study of the structure, actors, and dynamics of value chains that connect farm and forest products. The participants, linkages, structure of cost and benefit and dynamics of the value chain are studied.

The standardization of the production procedures in case of medicinal plant industry is important to develop a uniformity and acceptability in all parts of the world. The various processes of the value chain i.e. cultivation, maintenance, harvesting, processing, storage, packaging of the medicinal and aromatic plant industry are required to be standardized to meet the criteria for the certification as well as for the assessment of the quality and safety norms of the product and extracts thus produced. Certifications and the standardization define the safety and quality of the product that are essential in the international markets for the commodities to be traded abroad. The analysis discusses about the current scenario of value chain of the medicinal plant industry and how the standardization of the value addition contributes in the trade of medicinal and aromatic plants.

Keywords:Value chain; Medicinal plants; Uttarakhand; India; Herbal industry; Spices

Introduction

Background

Value addition is the process of economically adding value to a product by altering its current place, time and from one set of characteristics to other characteristics that are more favored in the marketplace [1]. Value addition is the process of creating value in existing value chain of a product. Value addition in medicinal plant industry starts at grass root level of cultivation of medicinal plants and primary processing of medicinal and aromatic plants which includes the procedures like cleaning, drying and sorting of medicinal plants at very initial phase of collection and harvesting of medicinal plants.

The basic theory for calculating the value addition at every level of the production process is the difference between the market price of the product and the total cost of production of the inputs used for the production (Figure 1).

The demand for chemicals and products derived from medicinal and aromatic plants is increasing globally and has opened up opportunities for entrepreneurs to add value to these plants through processing, thereby generating enormous employment avenues [2]. India has abundance of medicinal plants with 8000 medicinal and 2500 aromatic species which are mined for natural chemicals and processed for commercial products that are then exported globally. An upward trend has been recorded in the exports of medicinal and aromatic plants’ products in recent years which have encouraged Government and private organizations for developing processed products with medicinal plants. Value addition through processing involves employment of unskilled rural youth and unemployed, educated urban youth. A number of value added consumer products can be developed from a single medicinal or aromatic plant for trade in national and international markets.

Value chain actors

The returns received by the actors of the medicinal plant value chain namely villagers, middlemen and wholesaler, constitute the total trade in medicinal plants. The villagers constitute the first link in the trade in medicinal plants wherein the cultivators separately or combined collect the medicinal plant produce and take them up to the processors for further refinement. There upon, the middle men intervene in the medicinal plant trade and act as facilitators due to the lack of efficient infrastructure and link the cultivators to the wholesalers for commissions. The wholesalers are the distributors of the medicinal plant products to the ultimate markets and they carry out the work through a complex network of agents and retailers.

The medicinal plant value chain also included the secondary actors which are the industries that use the medicinal plants and their extracts as their input materials and then the value added to them through the processes operated on them through which the end products are obtained. The Pharmaceutical industries and the Cosmetic industries are the prime example of the value addition made to the medicinal plants. These industries use the medicinal and aromatic plants in fixed percentages and the final products made are the blend of multiple such plants and extracts.

Research motivation

The medicinal plant industry in the North Indian state of the Uttarakhand though is established, but the industry lacks a systematic structure and direction which can grant the various actors of the medicinal plant value chain proper guidelines and direction to develop the products that match the international quality standards. The international trade in medicinal plants and allied products is based on certain qualitative and safety standards which should be in place to ensure safety of the medicinal plants traded. The application and adherence of such standards in production of the medicinal plants in the country is eminent in order to explore the entire international trade potential of the medicinal plants.

For the purpose of analyzing the impact of value addition made by different actors of the medicinal plant value chain and the value added by the standardization of the production of medicinal plant products, qualitative method of analysis has been used. The existing studies have primarily focused on determining the value addition made by various actors of the value chain of medicinal plants. A very limited number of studies have explored the benefits of standardization of the various processes that are crucial to the quality of the end products of the medicinal plant industry. This study attempts to do that.

Objectives of the research

1. To understand the value chain processes in medicinal plant industry of Uttarakhand

2. To identify the issues in the value chain processes of the industry

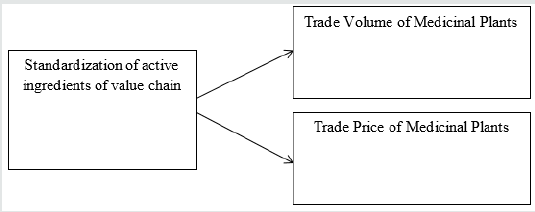

3. To analyze the impact of standardization of active ingredients of value chain on the trade

The study begins with the introduction of the study. The previous studies pertaining to the topic have been discussed in the literature review section. Research gaps have been identified in the same chapter and research framework has been formed. In the next chapter, research methodology has been stated in which the process that has been adopted during the entire course of the investigation has been discussed. Data analysis has been discussed in the succeeding chapter. This chapter is followed by discussions, conclusions, and recommendations for future work.

Literature Review

Value chain of MAPs

Value Chain (VC) defines a complete series of activities which are mandatory to carry the product or service from beginning through the different phases of production to the end consumer and discarding the product after its usage [3]. The value chain concept is an analytical approach that is been deployed used for evaluating the performance of the marketing initiatives of any industry or organization. This kind of analysis helps in identifying the loop holes in the performance system of marketing initiatives and implementing measures for refining the private and public interventions [4].

Medicinal plants and its related products have a wide ranging value chain activities associated with it. Recent estimates suggest that trade related activities of herbs is projected to attain a financial worth of US$ 5 Trillion by 2050. Realizing this increasing demand, it becomes important to assess the activities that can be restructured for smooth flow of medicinal herbs from producers to end consumers. This kind of analysis helps in understanding the difference that prevails in quality of the herbal medicines in different market zones and identify superior quality products over the inferior ones.

The value chain in medicinal plant industry comprises of the producers, collector, processors, wholesalers, exporters and distributors and retailer. The producers, or the cultivators or, the collectors are the upstream actors of the medicinal plant value chain and they provide the industry with the basic raw material and inputs for the other participants to function. While the processors, the wholesalers, the retailers, the traders and the exporters are the downstream actors of the medicinal plant value chain which provide the raw inputs of the medicinal plants with value and the capacity to the trade. The downstream actors enhance the utility of the medicinal plants and impart value to the products through processing and packaging of the products which increases the shelf life of the products.

Producers

The production system of MAPs products comprises of three major groups; wild crafters, plantation operators and cultivators. The three broad categories of producers differ according to the level of power they own, the practices they employ and the benefits they draw from these valuable resources. State Forest Departments are anticipated to control the harvesting of forest produce and are also expected to maintain a record of such produce. Thus, majority of information about the raw materials can directly be obtained from people working in the state forest department.

Collectors

Collectors are those middlemen who gather harvested herbal species from agriculturalists and wild crafters and make them available to processors. Because of the changeable demand of the products, collectors do not involve in the gathering process until they receive an order for the same. Formerly, several cooperative societies in Uttarakhand were assigned the role of collection process. Bhesaj Sangh, was one amongst the trusted collecting agency. But in the year 1986, Kumaon Mandal Vikas Nigam (KMVN) was started by the government officials to undertake activities pertaining to collection process and regulate the unnecessary exploitation of the growers. Thereafter, Garhwal Vikas Mandal Nigam (GVMN) was assigned the authority of regulating the allied activities of the medicinal plant agricultural sector. Despite this, Bhesaj Sangh, because of its consistent attention on collection of medicinal and aromatic plants,wasfar more popular in comparison to their counterpart.

Processors

Processing of the harvested medicinal herbs is done in two stages; semi-processing and alteration in the preparations. The first stage of the processing includes activities like cleaning the organic material stuck to the herbal species by drying; building concentrates, disinfecting, boiling and grinding. Marketing processed products adds value to their produce thereby allowing them charge higher prices for the same. The processing stage involves numerous activities including the drying, packaging, storage which enhance the shelf life and assist the marketing of the medicinal plant products.

Wholesalers and exporters

The wholesalers and the retailers constitute the organized part of the medicinal plant value chain. The links like the cultivators, collectors, processors and handlers in medicinal plant industry in Northern India are inherently unorganized and scattered in nature, while the downstream actors, the wholesalers and retailers are relatively formal in their structure. The wholesalers and the exporters provide the upstream actors of the medicinal plant value chain with valuable information of the trends and patterns of the consumer demand for the medicinal plant products in the domestic as well as in the international markets.

Distribution and retailing

The distributors and retailers play a crucial role in connecting the consumers to the producers through the wholesalers and help the consumers in attaining the products they desire. The medicinal plant cultivation usually is situated in the remote areas of the countries with abundant and rich biodiversity while a majority of the consumers are centered in the clusters of urban areas. The retailers provide the function of connecting the producers with the consumers. The retailers obtain the medicinal plants from the wholesalers and in certain cases, directly from the producers (processors) and offer the medicinal plant products in the market to the consumers for the ultimate consumption. The retail sellers of the medicinal plant industry also performs the function of acquiring the required credential sand certificates for the medicinal plants before such products can enter the consumer markets as the per the national and regional safety and quality norms [5].

The distributors, on the other hand perform, similar functions like the retailers but they interact with both the wholesalers and the retailers while the retailers interact only with the consumers.

Standardization of MAPs

Lazarowych et al. [6] in their study of the Standardization practices of the botanical drugs and the various strategies used for the standardization, have highlighted the standardization of the medicinal plants and the resultant botanical drugs has enabled the development of the required strategies for the enhancement of the quality of the products of the industry and maintenance of the homogeneity of the medicinal plant products. Well established system of standardization, according to Lazarowych et al. [6] can help to establish efficient control mechanisms for quality of the raw medicinal plants and the processed extracts of the plants. The need for standardization in medicinal plant industry has been further accentuated in a paper by Folashade et al. [7] which corresponds to the issue of standardization of the herbal plant industry. According to Folashade et al. [7] the standardization of the medicinal plant and the herbal product industry is eminent because of the act that the medicinal plants and the processes involved in their value addition are based upon a fine balance of constituents and are precariously time lined. Any deviation from the balance might lead to serious implications on the quality and nature of the end product. Without the standardization of the production and processing stages, the value chain actors may act independently and the resultant products might not be favorable for the consumers for the desired treatment of the ailments. The authors lay the responsibility of ensuring the safety of the consumers and the products that they consume on the Authorities’ shoulders and the safe procedures of production, harvesting, processing and packaging ought to be outlined by the authorities so that the ground rules for the production are set in the industry which can then be used as the basic criteria for judging the products and the assessment of the products can be assisted in similar manner.

Research gaps and framework

Certifications and the standards provide the products with the scientific seals of safety and quality that are essential in the international markets for the commodities to be traded abroad. The current study determines the importance of standardization of value chain processes by examining its impact on trade volume and trade price of Medicinal Plants (Figure 2).

Irrespective of the increasing demand and huge market size of the medicinal products, there is a huge gap in the amount of studies that have been undertaken in the context of value chain of medicinal plants, that too specifically in the context of Uttarakhand. There exist several prior researches which focus on determining the value addition made by the various actors of the value chain of medicinal plants but not many studies explore the benefits of standardization of the various processes that are crucial to the quality of the end products of the medicinal plant industry.

Research Methodology

The aim of the study is to understand the current status of value chain processes of medicinal plants in Uttarakhand and the impact of standardization of value chain processes on trade volume and trade price of medicinal plants. This is done because it has been observed that majority of the trade in this particular sector was happening in its raw form. The data has been collected from various government sources such as State government medicinal Plant websites: NMPB, ENVIS etc. and empirical research papers related to this area. The analysis provides information about the certifications the various systems of AYUSH, value chain practices, cost and benefits and trade related information of medicinal plants. The impact of standardization on trade volume has been analyzed in the data analysis.

For the purpose of satisfying this particular objective, analysis has been performed to ascertain the impact of the standardization on the Indian export of medicinal and aromatic plants and the allied products, the year in which the standards were established in the Indian medicinal plant Industry has been used as the benchmark year and comparative analysis has been done of the Indian trade in medicinal plants five years prior and five years post the standardization of the industry in order to gather the overall impact of the standardization on the economy.

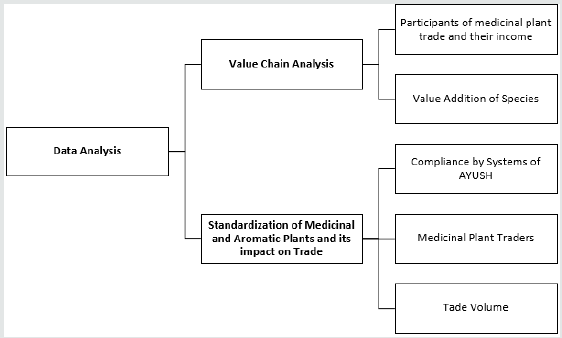

The study is descriptive in nature in the sense that it includes collection of data that explains events and then organizes to come up as a result. Secondary data related to quantity of medicinal plants collected/produced/traded have been collected from the records of the State Forest Departments in many research studies [8,9] (Figure 3).

Findings

Value chain analysis of MAPs in Uttarakhand

The value chain makes addition at every level of the production. The value chain actors are responsible for processing and adding value to the medicinal plants and developing the product to fulfill global demand. The value chain analysis of medicinal plants is done to understand the discrepancies in the process and to assess ways to improve the same.

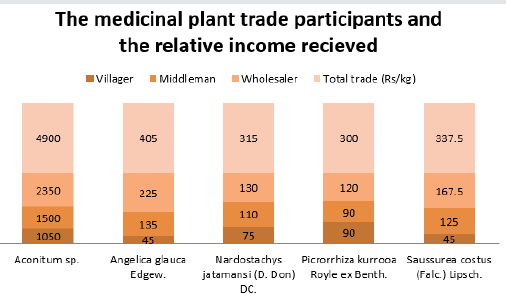

The division of the returns from the trade in medicinal plants among the various actors in medicinal plant trade has been depicted below. All through the medicinal plants under consideration, trend continues wherein wholesalers takes up the largest piece of the pie and get the largest share in the returns from total trade in the medicinal plants and returns to middlemen follow soon after for receiving the second highest share in the total returns from medicinal plant trade. The initial cultivator or villagers are the worst off group of players in medicinal plant trade (Figure 4).

There have been identified issues regarding the distribution of income and an attempt has been made to understand the probable reasons. One such reason can be unregistered and untrained farmers. Lack of training and understanding of the process and acknowledgement of market value of medicinal plants is the reason for unequal distribution of returns arising from sale of medicinal plants.

The analysis of the data set reveals a larger share of medicinal and aromatic plant trade going to the wholesalers which is contradicted by the findings of Shahidullah and Haque (2010) in their study of the relationship between the medicinal plant production and livelihood enhancement in the case of Bangladesh. Their study indicates that the primary and secondary- wholesale markets for the medicinal plants are dominated by the middlemen and not the primary producers and the wholesalers who benefitted from the trade in medicinal plants. According to their findings, the medicinal plant cultivation is sustainable for the relatively economically well off cultivators who usually have access to the better quality of land and the technical equipments. However, Shahidullah & Haque [10] also agreed that the small scale medicinal plant cultivators need to organize themselves in order to gain better holding in the market through an improved control over the quantity supplied in the market and hence the prices which determines their returns.

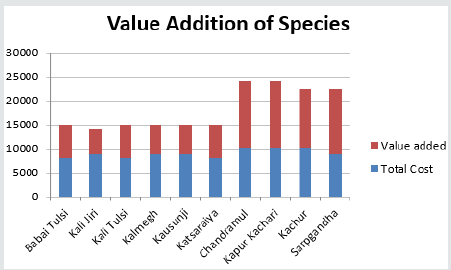

The value addition in specific species was also assessed. The comparative scrutiny of the value addition made by the cultivators for the given medicinal plants reveals that the value addition was the highest in the case of Chandramul, Kapur Kachari and Sarpgandha at Rs. 13680 while Kali Jiri had the lowest value addition made at the primary stage of cultivation. The value addition in the given data set was lowest for the plant Kali jiri while Kapur Kachari, Sarpgandha and Chandramul had the highest value added at the cultivation level of the medicinal plant value chain (Figure 5) (Table 1).

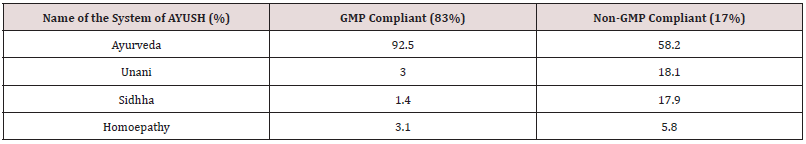

Table 1: System wise distribution (%) of good manufacturing practice and non-good manufacturing practice-compliant Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy pharmacies (Source: Samal, 2016).

Standardization of medicinal and aromatic plants and its impact on trade

The certifications of the value chain processes improve the tradability of medicinal plants since it assures the quality of the product to buyers in different countries. Certification programs have been introduced by Indian agencies as well to improve the acceptability of Indian medicinal products abroad. However, the compliance is not made mandatory for the companies and other participants. The systems wise distribution (%) of good manufacturing practice and non-good manufacturing practicecompliant Ayurveda, Yoga and Naturopathy, Unani, Siddha, and Homeopathy pharmacies has been depicted below that suggests that many of the AYUSH pharmacies do not comply to Good Manufacturing Practices and do not even have license.

AYUSH: Ayurveda, Yoga, and Naturopathy, Unani, Sidhha and Homeopathy

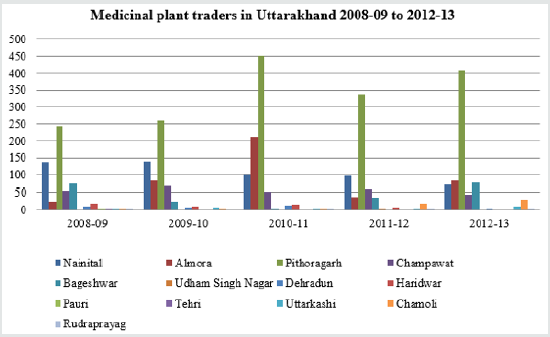

GMP: good manufacturing practices: The capacity of trade of medicinal plants in Uttarakhand has been assessed through number of traders present in different districts, amount of wholesale trade and trade through mandis. The district wise distribution of the medicinal plant traders in the state of Uttarakhand in the period ranging from 2008-09 to 2012-13 has been depicted below. In the year 2008-09, the total number of traders in the medicinal plant trade amounted to 571 and the highest number of traders were in the district of Pithoragarh while the lowest were in the districts of Rudraprayag. The year 2009-10, the total number of traders was 600 wherein the highest number of traders was in the Pithoragarh 259 and the lowest numbers of traders were in the Chamoli district of Uttarakhand. In the next year 2010-11, the total number of traders was 864 and the highest number of traders was in the Pithoragarh district while Uttarkashi and Rudraprayag had the lowest number of traders of the medicinal plants. The year 2011-12 witnessed the numbers of traders decline to 594 with the highest number of traders in Pithoragarh (337) and the lowest in Rudraprayag (1). The year 2012-13 witnessed an increase in the number of total traders to 732 with highest number of traders in the Pithoragarh district and the least traders in Rudraprayag. The number of traders in the given period increased from the 571 in 2008-09 to 864 in 2010-11 but declined to 594 thereafter in 2012- 13 (Figure 6).

The impact of standardization on trade has also been assessed. The voluntary scheme of standardization scheme introduced in the year 2009 was adopted by many companies involved in the value processing of medicinal plants. The impact of the scheme on the trade values of medicinal plants has been assessed and for this, pre and post 2009, figures of trade, when standardization was introduced for the medicinal plants has been compared.

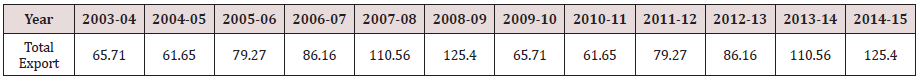

The exports figures of the medicinal plants in the years prior and post the launch of the standardization scheme by the government in the year 2009-10 have been depicted. The years 2003-04 to 2008-09 have been taken into consideration to grasp the export scenario of the medicinal plants before the launch of the medicinal plant standardization. In the year 2008-09, the total exports of the medicinal plant products was 125.4 million USD which was a major improvement since 2003-04 when the Indian exports of the medicinal plant products to the rest of the world used to be 65.71 million USD. The total exports for the given period amounted to 528.75million USD. The exports reached a high of 233.7 million USD worth of medicinal plant export in the year 2014-15. The total exports in the period ranging from 2009-10 to 2014-15 were almost the double of the total medicinal plant export of the previous period at 1068.22 million USD.

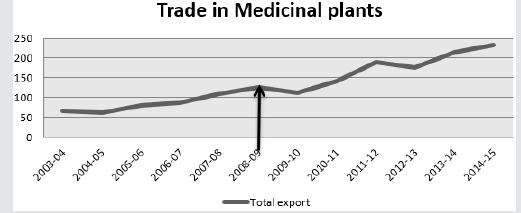

The trend of Indian exports of medicinal plants over the period ranging from 2003-04 to 2014-15 and the effect of the standardization on the total exports of the medicinal plants of the country have been analyzed. The year 2008-09 has been taken the bench mark year in which the National medicinal Plant Board of India introduced the standards in the Indian medicinal plant industry. The year post the introduction of the certification policies in the system saw a fall in the export of the medicinal plants for one year which picked up in the corresponding years. The Indian medicinal plant exports have improved over the year’s post the standardization of the industry which implies the positive impact the certification and standardization has had over the industry exports (Table 2) (Figure 7).

The analysis of the data reveals that the standardization of the medicinal plant industry does indeed has improved the foreign trade quantities of the Indian medicinal and aromatic plants in the foreign which is evident in the study of the pattern of trade which corresponds five years prior to the standardization and certification obligation (2004-05 to 2008-09) in the country and five year post the standardization (2009-10 to 2013-14) of the industry. The comparative analysis of the figures shows a boom in the Indian exports to the world in the years after the standardization was made compulsory in the year 2008-09 for the medicinal plant cultivators, processors and the marketers and traders. The basic requirement for the standardization of the medicinal plants is explained by Tierra (2002) in his research article discussing the need for standardization of the medicinal plants and extracts. Tierra emphasizes that the standardization of the medicinal plants and extracts would lead to a higher degree of technological refinement of the products of the industry as compared to unorganized system of the medicinal plants and the resultant products provide safer, stronger and more effective products that are supported by an adequate scientific evidence to substantiate the quality and the authenticity of the medicinal plants and the extracts and oils derived from them.

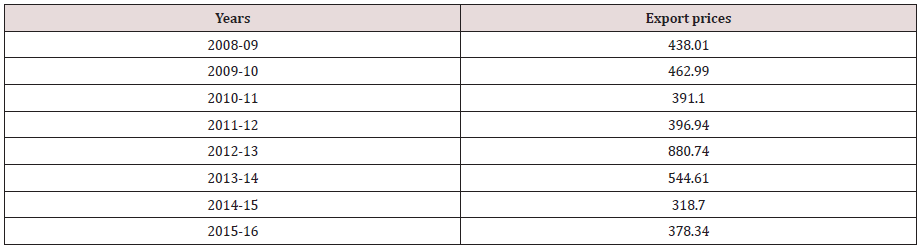

The standardization process is likely to minimize the gap between the prices offered in Indian market and international markets. Authenticated raw material is the basic starting point for the development and manufacturing of a botanical product. Harvesting, storing, processing and formulating methods may effect on the quality and consistency of the herbal product. Our herbal products are not getting international market because we are not capable to show the international standard of our products. A coordinated effort of all the supply chain actors and improved market facilities is likely to improve the export prices of the medicinal and aromatic plants; as discussed in Table 3. The rising export prices from the year 2008-09 till 2012-2012, shows that significant improvements were made in the traded prices of the medicinal produce. Thereafter the prices declined might be because of ineffective marketing strategies or poor market linkages.

Lazarowych et al. [6] in their study of the Standardization practices of the botanical drugs and the various strategies used for the standardization, have highlighted the standardization of the medicinal plants and the resultant botanical drugs has enabled the development of the required strategies for the enhancement of the quality of the products of the industry and maintenance of the homogeneity of the medicinal plant products. Well established system of standardization according Lazarowych et al. [6] can help to establish efficient control mechanisms for quality of the raw medicinal plants and the processed extracts of the plants. The need for standardization in medicinal plant industry has been further accentuated in a paper by Folashade et al. [7] which corresponds to the issue of standardization of the herbal plant industry. According to Folashade et al. [7] the standardization of the medicinal plant and the herbal product industry is eminent because of the act that the medicinal plants and the processes involved in their value addition are based upon a fine balance of constituents and are precariously time lined. Any deviation from the balance might lead to serious implications on the quality and nature of the end product. Without the standardization of the production and processing stages, the value chain actors may act independently and the resultant products might not be favorable for the consumers for the desired treatment of the ailments [11,12].

Conclusion

The standardization of the production procedures of the medicinal plant industry is eminent for the development of a more systematic, uniform and high quality medicinal and aromatic plant industry in India. The standards of the cultivation, maintenance, harvesting, processing, storage, and packaging function of the medicinal and aromatic plant industry are necessary to set up the criteria for the certification as well as for the assessment of the quality and safety norms of the product and extracts thus produced. Certifications and the standards provide the products with the scientific seals of safety and quality that are essential in the international markets for the commodities to be traded abroad. Further, the analysis talks about the current scenario in the medicinal plant industry wherein the returns are unequally distributed among the various actors of the medicinal plant value chain which leads to the low participation in the industry as well as the poor performance at the grass root level. The wholesalers and the middlemen in the state of Uttarakhand take up a majority of the medicinal plant sector’s revenue while the small scale cultivators receive little which impedes the performance of the sector. Medicinal plant sector in the North Indian state of Uttarakhand needs a systematic organization structure which assists the value chain actors in receiving the quantum of returns due to them and the injection of standardization and uniformity of the commodities produced which further enhances the value of the products in the domestic and the international markets. There are various issues identified in the value chain process of medicinal plants such as distribution of income among the various value chain participants, lack of training and understanding of the process and acknowledgement of market value of medicinal plants and lack of quality of products. These issues can be addressed through standardization of medicinal plants value chain and a strong plan to create awareness among the participants of value chain. The government of India in collaboration with the national medicinal plant board and the state medicinal plant boards has decided permissible level of contaminants in the production of selected medicinal plants. These level needs to be adhered to in order to gain local and state level permission from the authorities to function in the markets.

References

- Boland M (2009) How is Value-added Agriculture Explained? AgMRS, Value Added Agriculture

- Rao R, Sastry KP, Kumar R, Reddy P (2015) Value Added Products from Medicinal and Aromatic Plants. Central Innstitute of Medicinal and Aromatic Plants Resource Centre, Researchgate, 1: 1.

- Kaplinsky R, Morris M (2001) A handbook for value chain research. IDRC, Ottawa, Canada, p. 113.

- Chitundu M, Droppelmann K, Haggblade S (2009) Intervening in Value Chains: lessons from Zambia’s Task Force on Acceleration of cassava utilisation. Journal of Development Studies 45(4): 593-620.

- Choudhary D, Pandit BH, Kinhal G, Kollmair M (2011) Pro-poor value chain development for high value products in mountain regions: Indian Bay Leaf. International Centre for Integrated Mountain Development (ICIMOD), Nepal.

- Lazarowych NJ, Pekos P (1998) Use of fingerprinting and marker compounds for identification and standardization of botanical drugs: strategies for applying pharmaceutical HPLC analysis to herbal products. Drug information journal 32(2): 497-512.

- Folashade O, Omoregie H, Ochogu P (2012) Standardization of herbal medicines-A review. International Journal of Biodiversity and Conservation 4(3): 101-112.

- Shilpa S, Sharma R, Sharma S, Sharma A, Thakur N (2015) Trends and variability study of medicinal plants in Himachal Pradesh. International Journal of Farm Sciences 5(1): 149-162.

- Sher H, Aldosari A, Ali A, de Boer HJ (2014) Economic benefits of high value medicinal plants to Pakistani communities: an analysis of current practice and potential. J Ethnobiol Ethnomed 10: 71.

- Shahidullah AKM, Haque CE (2010) Linking Medicinal Plant Production with Livelihood Enhancement in Bangladesh: Implications of. The Journal of Transdisciplinary Environmental Studies 9(2).

- Samal J (2016) Medicinal plants and related developments in India: A peep into 5-year plans of India. Indian Journal of Health Sciences 9(1): 14-19.

- Kumar MR, Janagam D (2011) Export and import pattern of medicinal plants in India. Indian Journal of Science and Technology 4(3): 245-248.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...