Lupine Publishers Group

Lupine Publishers

Menu

Review ArticleOpen Access

Biomethane: Opportunities and Challenges on the Transitional Pathway to a Zero Carbon Future Volume 2 - Issue 3

Jeffrey M Seisler*

- Clean Fuels Consulting, USA

Received: December 16, 2022 Published: January 26, 2023

Corresponding author: Jeffrey M. Seisler, Clean Fuels Consulting, USA

DOI: 10.32474/JBRS.2023.02.000138

Abstract

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

Fossil fuels are being targeted for extinction due to their impacts on global warming. But the multiple transitional pathways to completely replace fossil fuels with renewable energy sources is a long journey that is not likely to be fully realized until at least the end of the 21st century. Adapting the existing fossil energy businesses and infrastructures while developing the renewable, alternative energy infrastructures (and adapting existing ones) will be key to the timing and success of the transition. Despite the aspirations and visions of many technologists and policy makers who see the‘long-term’ future at 2050, the trajectory of the transition will be lengthy, disruptive and uncertain. There are, however, some fuels and technologies contributing to the so-called circular economy that should not be sidelined or overlooked completely.

Keywords: Global warming; greenhouse gas; biomethane; bio waste

Introduction

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

Natural gas, comprised mostly of methane (CH4), recognized as the cleanest of fossil fuels, is under duress as a greenhouse gas (GHG) for its Global Warming Potential [1]. Fortunately, methane also has a renewable pathway – ‘the new molecule’ – as biomethane [2] created through anaerobic digestion (AD) [3] of agricultural waste (plant and animal), wastewater (solids, human organic materials, etc.), urban waste (organic landfill garbage), and a variety of other organic waste such as fats, oils and grease. Biomethane has been under-appreciated and sometimes ignored by many policymakers internationally in favor of liquid biofuels that have been seen as more compatible with traditional liquid fuels in internal combustion engines. Like every other fuel and technology, biomethane has both opportunities and challenges but, it can make a major contribution to reducing the human carbon footprint on a global scale as both an energy strategy as well as a waste management strategy.

An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

“Around the world, waste generation rates are rising. In 2020, the world was estimated to generate 2.24 billion tonnes of solid waste, amounting to a footprint of 0.79 kilograms per person per day. With rapid population growth and urbanization, annual waste generation is expected to increase by 73% from 2020 levels to 3.88 billion tonnes in 2050” [4]. All of the 105+ billion tonnes of organic wastes generated by humans directly or indirectly globally each year releases methane into the atmosphere as it decomposes [5].

Waste management is a major socioeconomic and environmental problem in urban and agricultural areas. For solid, non-bio wastes, hazardous and medical wastes, incineration is one popular approach to disposal. “Waste incineration is one of the main pillars of waste management. The thermal treatment renders the waste inert and sanitizes it (pollutant sink). Waste incineration also offers the possibility of generating electricity and heat. A large share of the inert slag remaining after incineration can be recovered following treatment that includes separation of metals, removal of impurities and ageing” [6]. In countries with strict regulatory controls, this is one solution that can help diminish the negative environmental impacts. But in countries incinerating solid waste without adequate air quality regulations or mitigation technologies, the resulting emissions and air pollution can be a major problem. But it is the bio-waste – urban, agricultural and municipal wastewater - that has the most potential for disposal and transformation into useful, low-global warming potential (GWP) biomethane energy. It also is an emissions mitigation strategy to alleviate large, global warming emissions contributors.

Urban/municipal Waste

In the U.S. landfills, where 50% of municipal waste is disposed, were the largest source of anthropogenic (human-induced) greenhouse gas emissions from waste management activities, generating 109.3 MMT CO2 Equivalent (CO2e) and accounting for 70.3 percent of total greenhouse gas emissions from waste management activities, and 16.8 percent of total U.S. CH4 emissions [7]. In Europe, where waste management has been subject to legal guidelines since 1999, reinforced in 2008, and subject to continued reduction targets (Waste Framework Directive [Directive 2008/98/ EC] and the Landfill Directive [Council Directive 1999/31/EC]), landfill accounts for about 3% of the Europe-27’s greenhouse gas emissions in 2020 [8]. Still, the high concentration of urban solids and bio-wastes (food, garden compost, and others) can provide a steady stream of fuel for the production of biomethane. For some cities, the use of land-fill-produced biomethane creates an environmentally closed loop whereby garbage is collected by trucks fueled by biomethane, brought back to the AD facility to unload the feedstock to the AD digester, and the trucks are fueled on-site (or at a local depot) to be sent out again to collect more feedstock to ‘fuel’ the biodigester.

Agricultural Waste

Agricultural waste -plant and animal wastes- when left on the ground, mixed into the soil or, (particularly in the case of manure) left untreated, provide a major source of global warming gases into the atmosphere; principally methane (CH4) and nitrous oxide (N2O). In the U.S., emissions from the agricultural sector account for almost 10% of total greenhouse gases. According to the U.S. EPA, “In 2020, agricultural activities were responsible for emissions of 549.7 million Metric Tons (MMT) of CO2 Eq., or 9.9 percent of total U.S. greenhouse gas emissions; methane, N2O, and CO2. Methane emissions from enteric fermentation (mostly methane output from the digestive systems of bovine and other cattle) and manure management represented 26.9 percent and 9.2 percent of total CH4 emissions from anthropogenic activities, respectively, in 2020. Agricultural soil management activities, such as application of synthetic and organic fertilizers, deposition of livestock manure, and growing nitrogen-fixing plants, were the largest contributors to U.S. N2O emissions in 2020, accounting for 74.2 percent of total N2O emissions” [9]. In Europe the agricultural sector accounts for 11% of greenhouse gases in the EU-27 region, however, only about 14% of that is related to field-waste, manure and fertilizers containing carbon [10].

Wastewater treatment

“In the United States, wastewater treatment generated emissions of 41.8 MMT CO2e (equivalent) and accounted for 26.9 percent of total waste sector greenhouse gas emissions, 2.8 percent of U.S. CH4 emissions, and 5.5 percent of U.S. N2O emissions in 2020. In the Europe-27 countries, water supply, sewerage, waste management and remediation activities accounted for 13.7% of the total greenhouse gases” [11]. Each of these large sources of waste products are the feedstock for biomethane production. As such these non-food-crop sources can be turned into useful energy and thus avoid excessive, uncontrolled GHG emissions.

Benefits of Biomethane are Scorned by Natural Gas Detractors

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

According to its detractors, the biggest problem with biomethane production is that…. it is methane! Many clean air and renewable energy advocates, particularly those committed to a single-path transition to electric vehicles, say that the development of the biomethane infrastructure and industry merely perpetuates the use of ‘dirty’ fossil gas – the ‘old molecule.’ Critics complain that ‘anything natural gas’ prolongs the useful life of the fossil fuel infrastructures – production, transmission and distribution -- and the businesses upon which they are based. But the renewablebased electricity sector is not developed enough, nor is it likely to globally fulfill by 2050, increased electric energy demands from the transportation sector (even if it is limited to light duty vehicles). Additionally, a dramatic increase in demand for air-to-air heat pumps, which are efficient at ambient temperatures above freezing but below freezing must rely on inefficient, expensive electric resistance heating backup, also will strain electricity output.

Thus, diversity of renewable fuels, including biomethane, must be part of the transition to the longer term, zero carbon future. Methane skeptics and detractors note, with some justification, that methane leakage from the compressor and pipeline systems is an on-going problem. But the gas industry isn’t ignoring these realities and has intensified its work internationally to mitigate methane leakage. In the U.S., for example, gas utility industry methane emissions have decreased by 69% since 1990 due to concerns and efforts by the industry to ‘clean up its act’ and decarbonize [12]. The European Union aims to reduce natural gas infrastructure leakage by 29% compared to 2005 levels by 2030 [13]. Ardent critics such as Transport and Environment, self-identified as Europe’s leading non-governmental organization.

(NGO) campaigning for cleaner transport, attacks ‘everything gas’ (light and heavy duty NGVs; LNG in shipping, etc.) in favor of ‘everything electric’. T&E makes broad assumptions about the potential supply and application of biomethane, claiming that, “The very limited availability of sustainable sources (e.g. waste) means bio-methane can only be used in niche applications.

Any scaling up of production would require crop-based biomethane which raises issues related to direct and indirect landuse change and reduced greenhouse gas benefits. The air quality benefits of biomethane are small and the same as natural gas. Policymakers also need to reflect on whether the limited amount of sustainable bio-methane would not be better used in other sectors (for example, heating) …Similar to biofuels and diesel, it needs significant support (including subsidies or tax breaks) to survive. The evidence shows such support is not justifiable and is better spent on long-term solutions: fuel efficient, electricity-powered, and shared transport” [14].

This Euro-centric view negates the global realities about the socioeconomic and environmental benefits of biogas and biomethane as a combined waste mitigation and energy strategy. Such views attempt to undercut the overall production potential for renewable natural gas; also assuming erroneously that food-based crops must and will be part of the feedstock mix.

Growth of Decentralized Production, Large and Small

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

“The beauty of anaerobic digestion is its versatility. It can be installed on a micro level to recycle a household’s waste, and for cities large scale merchant facilities can recycle 500,000 million tonnes annually. It can handle wet or dry waste, or a mix of both, and can be used in conjunction with composting depending on the soil requirements in a given geographical area. It extracts the greatest value out of organic wastes and turns them into valuable renewable resources” [15]. Small scale waste-to-energy systems have been used worldwide for centuries to supply biogas for cooking and heating. Larger, more expensive and extensive AD systems scaledup to create biomethane in larger quantities are the more recent but proven technological development that demonstrate the importance and potential of biomethane in the variety of demand sectors already served by natural gas.

The AD systems have a full range of tank sizes and applications:

a) Micro systems: 0.2m3-100m3 tanks for applications ranging from individual household cooking and heating to small-scale combined heat and power.

b) Small systems: 100m3-~1000m3 tanks applicable for gas heating.

c) Medium systems: ~1000m3 tanks suitable for combined heat and power up to 1mW electricity or for upgrading to biomethane more than 2.5MW.

d) Large-scale systems: ~4000m3 tanks for biomethane upgrading more than 2.5MW but also enough to power the AD plant itself [16].

As such, biogas and biomethane production is decentralized across both the urban and agricultural landscapes with a wide variety of applications worldwide on a small-scale for localized use or able to provide large-scale urban facilities that add low-carbon renewable energy into the existing natural gas pipeline.

Another benefit of biomethane, upgraded to pipeline quality (generally 95-97% methane) is its flexibility in distributing it to the end users. Biomethane can be injected into and transported via the existing natural gas pipeline, compressed into large multitube trailers to be hauled where it is needed (e.g. to a compressed natural gas [CNG] fuel station or commercial facility) or piped directly via a dedicated biomethane pipeline from the production/ cleaning facility to local distribution points, as has been done for example, to CNG fuel stations. This flexibility of multiple pathways of distribution makes biomethane accessible to both urban and agrarian-located customers, whether they are connected to the natural gas pipeline grid.

Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

The long-term outlook for fossil natural gas – 2050 and beyond – is seen as a transitional decline across many energy sectors, particularly in the developed economy countries. For developing economy countries where gas infrastructures are expanding, the transitional decline likely will, eventually, follow the same downward trajectory. Commitments by nations to move toward renewable energy and, in the longer term to renewablebased hydrogen will have an impact on reduced demand for fossil energies – gas and oil. This will be due to a combination of policy, mandates, and normal market forces based on price and availability of competing energy sources. The International Energy Agency World Energy Outlook 2022 projects, that by 2050 fossil natural gas meets 15% to 40% less demand for gaseous fuels below their 2021 levels. Under its different scenarios to 2050 renewable biogases (hydrogen and others) reach more than 400 bcm by 2050; around 65% (260 bcm) is biomethane, which is mostly injected into gas networks or otherwise in containers as bio‐CNG mainly for use in the transport sector. The overall share of low‐emissions gases in total gaseous fuels reaches over 70%, from less than 1% in 2020. (Natural gas used with carbon capture, utilization, and storage [CCUS] accounts for the remainder). Biogas rises to nearly 340 bcm equivalent (bcme) by 2050 from about 35 bcme today. Over 40% of biomethane and biogas are developed in the Asia Pacific region [17].

If biomethane is increasingly recognized by policy makers (and, thereby, the larger players in the fossil energy industries) as a valuable addition to the mix of renewable energies and as an waste/emissions mitigation strategy, its outlook also looks positive for the growth of biomethane facilities and gas production. In the U.S., as of 2020, “The total number of Renewable natural gas (RNG) production facilities that were operational, under construction or planned, increased by 42% -- from 219 in early 2019 to 312 by the end of 2020. That includes 157.

Renewable natural gas (RNG) production facilities in operation (up 78% from 2019); 76 projects under construction (up 100%); and 79 projects in planning. The 157 operational projects as of the end of 2020 producing RNG represent total production capacity of over 59 million MMBtu, the equivalent of over 459 million gallons of diesel – enough to fuel 50,000 refuse trucks (nearly 40% of the refuse trucks in the US). That represents a 30% increase in production capacity since 2019. And with 155 new RNG projects under construction or being planned, rapid capacity growth should continue in the years ahead” [18].

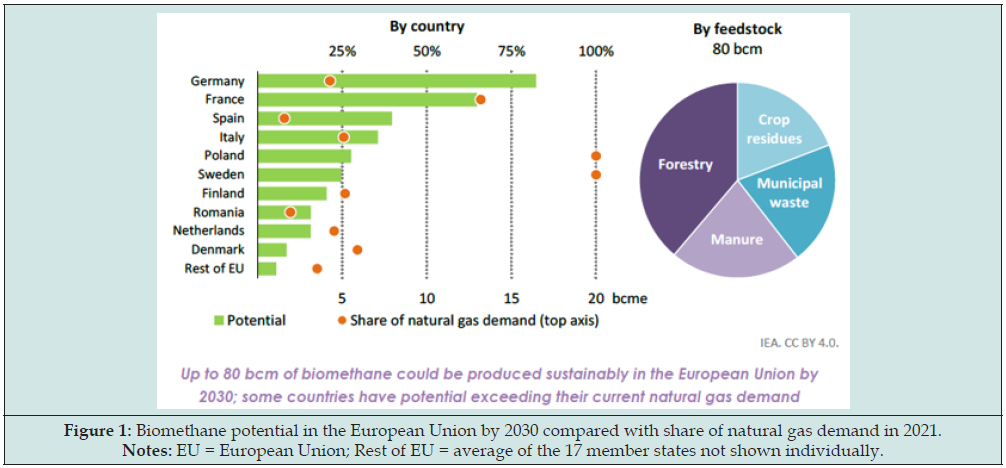

“The European Union is (author note: finally!) supporting the scaling‐up of biomethane, where there is significant potential across the region. Around 3 bcm of biomethane and 9 bcme of biogas is currently produced (most of the latter is directly consumed in local production of electricity and heat). The growth in biomethane production envisioned in the RePowerEU Plan implies a 35% average annual growth rate from 2022‐30 compared to 20% in 2015‐21, suggesting that 35 bcm of biomethane could be produced in the European Union” [19]. As of 2019, “There were over 540 upgrading plants operating in Europe with 195 in Germany, 92 in the UK, 70 in Sweden, 44 in France, and 34 in the Netherlands. Outside of Europe, there were about 25 in China, 20 in Canada, and a few in Japan, South Korea, Brazil and India. Based on the data available, it is estimated that 700 plants upgrade biogas to biomethane globally” [20]. Figure 1, below, shows the IEA’s view of biomethane potential in the European Union by 2030 compared with share of natural gas demand in 2021, with some countries potentially producing more biomethane than their overall demand for natural gas [21].

Figure 1: Biomethane potential in the European Union by 2030 compared with share of natural gas demand in 2021. Notes: EU = European Union; Rest of EU = average of the 17 member states not shown individually.

Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

The widespread and growing policy support for electric vehicle technologies (EVs) has forced NGVs to a ‘fork in the road’ as to what future markets are the most promising. The current and growing market penetration of light duty EVs, despite challenges rolling out the charging infrastructure, has significantly reduced the opportunities for light duty (LD) NGVs. But for the heavy-duty vehicle sector, EVs have some significant technical challenges – particularly battery weight/space, higher voltage fast-charging availability and cost – that affect their competitiveness compared to heavy duty natural gas trucks, both CNG and LNG. Of course, fuel price relative to diesel will be a benchmark that is reflected in the Total Cost of Operation (TCO) that will affect the attractiveness of all the fuel alternatives.

As for environmental benefits in the transportation sector (cars and trucks) renewable biomethane must be viewed on the full fuel and emission cycle – well-to-wheel (WTW) basis (fuel production to tailpipe). On a WTW basis, cars fueled by biomethane reduce greenhouse gas (GHG) emissions from conventional gasoline cars by as much as 85%, depending on the waste material used to produce the methane. On a tank-to-wheel basis (TTW) the biomethane vehicles achieve approximately 30% less emissions than direct injection, spark ignited cars. Sourced from manure in closed digestate storage, the resulting biomethane on a well-to-tank (WTT) basis is nearly minus -225 gCO2/km compared to gasoline; for WTW it is nearly minus -150 CO2equivalent/km. Derived from from municipal waste, on a WTT basis CO2 emissions reductions are between minus -50-to-75gCO2e/km [22]. In California, the carbon intensity of bio-CNG in their statewide systems was scored at minus -16.57 gCO2e/MJ (First quarter, 2021) [23].

There is good news for the biomethane markets in the transportation sectors in both the U.S. and Europe:

a) In the U.S. in 2020, of the 646 million gasoline gallons equivalent (GGE) used in all on-road NGVs, 53% was renewable natural gas (RNG), saving 3.5 million tons of CO2equivalent. This was 25% over 2019 fuel volumes and more than 267% since 2014 [24]. In California, 98% of all on-road fuel used in natural gas vehicles in 2021 as renewable natural gas [25]. NGVAmerica predicts that by 2030, 80 percent of NGV motor fuel in the U.S. will be derived from renewable sources, rising to 100 percent by 2050 [26].

b) In Europe, (May 2020), of the 4,120 CNG and LNG fuel stations, more than 25% were delivering biomethane to European NGV consumers, representing a 17% average of all gas used as a transport fuel (2.4 bcm/23.4 TWh). The latest NGVAEurope Roadmap targets the share of biomethane as a proportion of gas used in transport to reach 55% by 2030; 75% by 2040; and 100% by 2050. (15 billion m3 by 2050) [27].

The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

The fact is the natural gas industry is not going away in the near future although there is an on-going need to ‘decarbonize’ the supply and demand networks.

a) “The U.S. natural gas pipeline system has evolved from local manufactured gas networks serving municipalities in the mid-1800s to a vast network of interconnected pipeline systems comprising 2.44 million miles of pipe, 400 underground storage facilities, and 1,400 compressor stations” [28]. In 2021, the natural gas transportation network delivered about 27.6 trillion cubic feet (Tcf) of natural gas to some 77.7 million consumers, or about 34% of the nation’s energy” [29].

b) Europe has 2.2 million kilometers of transmission and distribution pipelines, delivering 21.5% of the EU’s primary energy consumption. 40% of households are connected to the gas grid. Four percent of total gas consumed in the EU-27 in 2020 was biogas, with total volumes more than doubling in the last 10 years [30].

c) Currently India has a national gas grid of about 17,000 kms (10.6 thousand miles) but, to provide adequate distributed natural gas to all parts of the country is in the process of expanding this by an additional 15,500 kms (9,631 miles) to provide natural gas to all parts of the county [31].

d) Other developing economy countries like Brazil and China also are expanding their natural gas pipeline networks as well as their biogas and biomethane production and supply.

The pathways to decarbonize the gas supply include: renewable natural gas feed-in to the pipeline network; hydrogen blending; methanated hydrogen [32]; and, potentially, reconstitution of the pipeline network to become a dedicated hydrogen infrastructure. The two near-term propositions are biomethane feed-in, which currently is the most prevalent change to the gas industry distribution system and, under consideration as well as research and demonstrations, some degree of hydrogen blending into the gas network. According to the American Gas Association, “All options should be on the table to ensure a cost-effective, reliable, resilient and equitable transition to a net-zero emissions energy system” [33].

Challenges and Necessities for a Successful Transition

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

Gas industry and biomethane supplier issues

a) Whose gas is it? The decentralized nature of biomethane production (focusing on larger facilities upgrading biogas to pipeline quality gas) also means that there are multiple owners of these facilities, such as private energy companies and municipalities. The large oil/gas producers also see the potential for biomethane and are moving into the field. Shell announced in November 2022 that it is acquiring Nature Energy Biogas, A/S, Europe’s largest producer of renewable natural gas, for €1.9 billion (US$ 2 billion), subject to regulatory approval. Shell’s statement reflects a new reality for biomethane’s future, saying, “Acquiring Nature Energy will add a European production platform and growth pipeline to Shell’s existing RNG projects in the United States. We will use this acquisition to build an integrated RNG value chain at global scale, at a time when energy transition policies and customer preferences are signaling strong growth in demand in the years ahead” [34]. Total Energies, the French-based multi-national gas and oil supplier also is making an increasingly large commitment to biogas/biomethane, with U.S. and European bio-CNG and LNG retail outlets serving NGV customers. “At Total Energies, we are convinced that biomethane has a role to play in the energy transition, both as a low carbon alternative to natural gas and as a fuel for land and maritime transportation. We therefore increase our investments to contribute to the development of this renewable gas” [35].

b) Biomethane feed-in: Making the meters run backwards. Gas distribution companies are in the business of providing energy to customers. But, as with renewable electricity produced from residential and commercial facilities that feed energy back into the electric grid, natural gas network owners must make concessions for renewable biomethane fed back into their grid; metaphorically, ‘making the meters run in reverse.’ Establishing feed-in locations can be costly for the network provider and a price must be established for the supplier’s biomethane.

In Europe, Directive 2009/73/EC of the European Parliament and of the Council , 13 July 2009 concerning common rules for the internal market in natural gas specified that (paragraph 26), ““Member States should take concrete measures to assist the wider use of biogas and gas from biomass, the producers of which should be granted non-discriminatory access to the gas system…,” The caveat to this is the requirement that access of biomethane to the pipeline depends on the gas being pipeline quality (e.g. ~95-97% methane) and, that it is “permanently compatible with the relevant technical rules and safety standards. Those rules and standards should ensure that those gases can technically and safely be injected into, and transported through the natural gas system and should also address their chemical characteristics”. Since the advent of biomethane as a viable energy source, standards and regulations have been developed so that both gas producers, sellers, network operators and customers can be assured of the highest quality biomethane regardless of its origin [36].

Despite the ‘non-discriminatory’ clause, initially some countries prohibited biomethane from landfill and other sources. One European country refused to create a rate for biomethane from a producer who wanted to sell the gas to NGV customers, although the regulators had created a rate for biomethane used in electric power plants, where they claimed the country would derive better CO2 reduction benefits than from biomethane used in the vehicle transportation sector. This was illegal under European law and eventually biogas for the vehicle market became possible.

c) What’s the price (tariff) for feed-in gas? The rate paid to the producer is a main factor in determining the overall economics across the entire biomethane value chain from the producer to the ultimate customer. Tariff-setting seems to be an open issue for many governments, producers, network operators and end users. Pricing strategies, rules and regulations differ across political and geographical jurisdictions. Tariffs often are subsidized. Rates sometimes are specified for the buyer and seller. Sometimes governments allow a free-market approach on price-setting and others are regulated. Also, biomethane tariffs can vary by biogas feedstock, end use, or other conditions. Whatever the process, developing a fair, competitive market rate for gas – in particular in relation to fossil gas in the network – is of paramount importance to the success of the overall biomethane market and its sustainability.

d) Accounting: biomethane in-biomethane out. There are many retail sellers of gas that provide biomethane directly from a biomethane facility or that receive their supply from a tank truck. Providing subsidies, discounts or crafting incentives specifically for biomethane can be implemented easily when the biomethane source is known. When the gas is injected to the grid it mixes immediately with the fossil gas. If a jurisdiction wants to subsidize biomethane blended into the network, then a functioning, accurate accounting system must be developed to determine the amount of biomethane in, and then account for a similar quantity on the demand side. Switzerland developed such a system whereby NGV users could take advantage of biomethane subsidies at specific fuel stations. But when the grid dispensed the equivalent amount of gas as there was biomethane injected into the grid, the NGV customer would no longer receive the price subsidy.

e) Biomethane production infrastructure: The cost of gearing up. Investments in new biomethane production and infrastructures are critical but not cheap. Scaling up the European biomethane infrastructure will require investments of €48 billion to build 4,000 medium-size units and €35 billion to build 1,000 large-scale plants [37]. “Factors that could accelerate cost reduction and production growth include streamlined permitting procedures, factory‐style fabrication of standardized biodigesters and related equipment, pooling of feedstocks, dedicated biogas financing facilities, and policy measures such as quotas, and favorable feed‐in tariffs” [38].

“The production costs for biomethane produced by thermal routes, and Fischer-Tropsch (FT: gas-to-liquids) or gasoline hydrocarbons fall in the range of 75-144 EUR/MWh. Using waste as a feedstock at a gate fee of 0 or 12.5 EUR/MWh, the corresponding production cost falls in the range of 53-104 EUR/MWh. The data shows that producing biofuels or biomethane from wastes is significantly cheaper than from biomass feedstocks. Although capital costs are not significantly different for plants using the two different types of feedstocks, the overall cost is influenced by the negative waste feedstock costs. It also shows that producing FT products or gasoline hydrocarbons are significantly more expensive than producing methane or methanol, given the added process complexity and energy requirements” [39].

a) Creating markets for biomethane production residuals. Two principle results of anaerobic digestion are solid digestate and CO2. “Much of the world’s artificial nitrogen fertilizer is produced through a process that takes fossil gas and vast amounts of energy (and associated CO2 emissions) to fix nitrogen in the form of ammonia”. Biogas digestate is “a renewable fertilizer rich in key nutrients, nitrogen, phosphorus, and potassium (NPK), recovered from the nutrients in the input organic material. Digestate reduces the need to manufacture non-renewable mineral fertilizers” [40]. “Digestate yields vary depending on the volatile solids content and methane potential of different feedstocks; 35 bcm of biomethane production could yield significant quantities of nitrogen biofertilizer, reducing mineral fertilizer use. In addition, it could avoid methane emissions if the digestate is responsibly handled and stored. There is also potential to use the relatively pure stream of CO2 associated with the biogas upgrading process to produce synthetic methane” [41]. This high grade fertilizer can be sold, given, or traded for more waste products back to the farmers, for example, who are providing their waste products to the anaerobic digester.

Similarly, the biologically derived CO2, which is 35-45% of the resulting gaseous phase of AD, has a potential market in the food and drinks industry as well as for green houses that normally can have CO2 injected in their structures to enhance plant and flower growth.

a) Competition in the waste stream. What is garbage worth, and to who? The expression, “One person’s garbage is another person’s treasure,” is particularly true for municipal and private waste facilities. “Fuels made from wastes and residues are in particularly high demand because they satisfy GHG and feedstock policy objectives in the United States and Europe. In fact, wastes and residues are expected to be used for 13% of biofuel production in 2027, up from 9% in 2021. However, (for liquid biofuels) demand is approaching the supply limits of the most-used wastes and residues. Nevertheless, markets are dynamic. High prices are a signal to seek out new supplies, which is prompting the development of government programs and industry innovation to help avoid the crunch” [42].

The role of governments in helping to develop a sustainable market for biomethane.

There are numerous tools and options available to governments to promote multi-fuel pathways to the future and stimulate markets for technologies and fuels, including: financial and non-financial incentives; mandates (work best in conjunction with incentives); creating standards and regulations; funding of research, development, and demonstrations (RD&D); and using the fuels and technologies in local, regional and national government buildings and vehicles.

Financial incentives include but are not limited to:

a) Policy makers, in all their options, need to consider the well-to-tank and well-to-wheel emissions as well as the complete Life Cycle Analysis (LCA) of all the fuel alternatives. This is essential to developing sensible ‘fuel and technology neutral’ approaches to achieving a zero-carbon future. Setting policy based only on zero tailpipe emissions (e.g., EVs) is not a ‘zero carbon’ strategy, since the source of the electrical generating fuel should be considered as part of the overall emissions contribution.

b) A variety of financial incentives can be tied to the type of waste product used and the CO2 equivalent reductions achieved in the process. In this case, there can be distinctions between food-crop-based feedstock and pure waste-type feedstock, the latter of which is the principal feedstock for biomethane.

c) Ensuring balance in fuel taxation that recognizes equivalent energy content of fuels and/or recognizes potential emissions benefits of a fuel.

d) Lowering taxes of the production, injection, sale and consumption helps incentivize various actors across the biogas and biomethane value chain.

e) Financial incentives provided for returning digestate to the agricultural sectors.

f) Incentivizing reverse flow facilities for network operators.

Development of standards (non-binding ‘models’) and regulations (codification of standards that can be implemented and enforced by government regulators) have and will play an important role in facilitating biogas and biomethane markets.

a) Codifying gas quality and gas composition standards is critical to maintaining the safety and integrity of both pipelines as well as over-the-road tube-transport systems delivering gas to individual customers or to fuel stations.

b) Facilitating local codes to reduce the time and procedures to build AD plants.

c) Encouraging municipalities to re-evaluate waste management procedures such as incineration and encouraging (or mandating with incentives) localized biomethane production to reduce emissions from solid and liquid waste storage sites and instead create useful renewable energy for local communities (including electric generation).

In regard to crops, sustainable sequential cropping might be encouraged, whereby non-food crops can be produced when food crops are not being grown. This would require creating a list of advanced feedstocks to fulfill the non-food obligation. ‘Certificates of Origin’, a system used in Europe, also comes into play to ensure that biomethane is not derived from food crops (as are some liquid biofuels).

Last but not least, governments should accelerate sponsorship of research, development and innovations for biomethane, along with the very large financial efforts directed to hydrogen. This will be particularly important as the existing natural gas infrastructure is revolutionized, to share and ultimately be dedicated to more renewable gaseous fuels as fossil gas fades into history.

Energy and Technology Transitions are Complex and Take Time

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

It is critical to the maximization of the socioeconomic and environmental contributions of biomethane to educate policy makers about its potential and benefits. Unfortunately, policy makers in the U.S., Europe and elsewhere have become singlemindedly enamored with the vision of a renewable electric future that will serve world society with carbon-free energy; not necessarily including renewable gaseous fuels other than hydrogen. The ‘long-term future’ is viewed as 2050 and there is diminished understanding among policy makers and electrification advocates of the need to have a multi-energy, transitional pathway that ultimately will result in a zero-carbon future that will be achieved well beyond 2050. Market forces, market demand and, ultimately, customer preferences should dictate fuel and technology choices into the future. Instead, governments in Europe and the U.S. (California and New York) are creating zero emission vehicle mandates by 2035; or outright banning the sale of internal combustions engines (ICEs). This approach will limit other fuel alternatives that currently are being developed for cleaner ICEs; liquid biofuels, biomethane; and even hydrogen (as a steppingstone toward hydrogen fuel cells). Such technological short-sightedness by policy makers is reflected even in the most recent Biden administration U.S. Blueprint to Decarbonize America’s Transportation Sector, which aims to secure a 100% clean electrical grid by 2035 and reaching net-zero carbon emissions by 2050 [43]. The plan recognizes the role of liquid biofuels but makes no substantive mention of biomethane, (possibly due to the negative bias against all things fossil natural gas?).

The World Energy Outlook 2022 has a different view of the 100% clean electrical energy grid and the time to achieve it under three different scenarios, none of which achieve a 100% renewable energy outlook by 2050. “Global electricity demand in 2050 is over 75% higher in the Stated Policies Scenario (STEPS) than it is today, 120% higher in the Advanced Pledges Scenario (APS) and 150% higher in the Net Zero Emissions by 2050 (NZE) Scenario”. They see, in these three scenarios, the share of renewable electricity by 2050 as being, respectively, 65%, 80% and 88% [44]. The Inflation Reduction Act in the United States, the Fit for 55 package and repower EU in the European Union, the Green Transformation (GX) program in Japan, Korea’s target to increase the share of nuclear and renewables in its energy mix, and ambitious clean energy targets in China and India all are policies aiming to correct the historical world energy pathways that have resulted in the current climate upheaval facing the globe. As the Executive Director of the IEA, Dr. Fatih Birol, says in the Forward to the WEO 2022 Outlook, The successful energy transitions must be fair and inclusive, offering a helping hand to those in need and ensuring the benefits of the new energy economy are shared widely. Even as countries struggle to manage the brutal shocks from the (climate) crisis, the last thing we should do is turn inwards and away from supporting each other. Instead, we need to work together to build trust [45]. Until we find an ultimate fuel panacea (many believe nuclear fusion will be that panacea) all energy and technology options should be considered in the transition to the net-zero carbon future, including renewable biomethane. Most of all, policy makers and clean fuel/ energy advocates must realize that the future is a big place, and it’s going to take a long time to get there.

References

- Abstract

- Introduction

- An Abundance of Urban Garbage and Agricultural Waste Also Contributes to Global Warming

- Benefits of Biomethane are Scorned by Natural Gas Detractors

- Growth of Decentralized Production, Large and Small

- Despite Challenges for Fossil Methane, the Outlook for Biomethane is Optimistic

- Natural Gas Vehicles (NGVs) are a Growth Market for Biomethane

- The Global Natural Gas Industry Infrastructure Isn’t Going Away; (but will have a transition to decarbonization)

- Challenges and Necessities for a Successful Transition

- Energy and Technology Transitions are Complex and Take Time

- References

- Compared to carbon dioxide (CO2), the baseline measure for Global Warming Potential (GWP) and the most prevalent global emission contributing to global warming, methane is about 25-30% higher over a 100-year period than CO2 and 81-83 higher on a 20 year basis. The other important GHG is nitrous oxide (N2O), which has a GWP of 298 over a 100-year period. (U.S. EPA and Intergovernmental Panel on Climate Change metrics).

- ‘Biogas’, a combination of methane and mostly CO2, are the initial products of anaerobic digestion (AD). Biomethane, also referred to in the U.S. as Renewable Natural Gas (RNG) is the upgraded product processed as suitable for pipeline injection.

- Anaerobic digestion is a process through which bacteria break down organic matter in the absence of oxygen. Digester gas contains approximately 65 percent CH4 (a normal range is 55 percent to 65 percent) and approximately 35 percent CO2 (WEF 2012; EPA 1993). Methane emissions may result from a fraction of the biogas that is lost during the process due to leakages and other unexpected events (0 to 10 percent of the amount of CH4 generated, IPCC 2006), as reported in EPA (2022) Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2020, U.S. Environmental Protection Agency, EPA 430-R-22-003, Pp. 7-85, USA.

- (2022) Solid Waste Management. World Bank Brief, USA.

- (2021) Biogas: Pathway to 2030. World Biogas Association p. 5, UK.

- German Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection, on Waste Incineration. Berlin, Germany.

- EPA (2022) Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2020, U.S. Environmental Protection Agency, EPA 430-R-22-003, pp. ES-20 and 7-18, USA.

- (2022) Climate Change-Driving Forces-Agricultural emissions. Eurostat.

- Cit. EPA 2020 Inventory, p. 5-1.

- European Energy Agency. Republished by Eurostat (env_air_gge).

- Eurostat (env_ac_aeint_r2) Table 2: CO2 intensity by economic activity, EU, 2008 and 2020.

- (2022) Net Zero Emissions Opportunities for Gas Utilities. American Gas Association, p. 2, Washington DC, USA.

- The Role of Gas in a Transition Phase Towards Decarbonisation, ACER Fact Sheet. European Union Agency for the Cooperation of Energy Regulators. Slovenia, Europe.

- (2016) NGVs on the Road to Nowhere, briefing by Transport and Environment. Slovenia, Europe.

- (2021) Biogas: Pathways to 2030, World Biogas Association p.14, UK.

- p.6.

- World Energy Outlook 2022, International Energy Agency, Chapter 8, Outlook for Gaseous Fuels pp. 370, 377, 380.

- (2020) Energy Vision/Argonne Study Shows Rapid Expansion of the US Renewable Natural Gas Industry, Energy Vision, Cision, USA.

- Cit. World Energy Outlook 2022.

- (2019) Global Potential of Biogas. World Biogas Association, UK.

- Cit. World Energy Outlook 2022 p. 395.

- Well-to-Wheels analysis of future automotive fuels and powertrains in the European context. Joint Research Center (European Commission), report v5: pp. 63, 83.

- (2021) Natural Gas Vehicle Industry Moves Closer to Full Carbon Negative Future. NGVAmerica, USA.

- (2021) Decarbonize Transportation with Renewable Natural Gas. NGVAmerica, USA.

- (2022) California Fleets Fueled with Bio-CNG Acieve Carbon-Negativity for Second Straight Year. NGVAmerica, USA.

- (2021) Statement on Climate Change. NGVAmerica, USA.

- (2022) An industry declaration to deliver the Green Deal and achieve net zero CO2 emissions in commercial road transport with biomethane. NGVAEurope, Europe.

- MW Melaina, O Antonia, M Penev (2013) Blending Hydrogen into Natural Gas Pipeline Networks: A Review of Key Issues. National Renewable Energy Laboratory (NREL) p viii.

- (2022) Natural Gas Explained; Natural Gas Pipelines, US EIA, and Op.Cit. Net Zero Emissions. AGA p. 2.

- The Role of Gas in a Transition Phase Towards Decarbonisation, ACER Fact Sheet, European Union Agency for the Cooperation of Energy Regulators.

- Natural gas Pipelines. India Ministry of Petroleum and Natural Gas, India.

- (2021) Hydrogen can be converted into methane using the CO2 contained in the biogas resulting from anaerobic digestion of wastes (gas typically made of a large share of methane and a smaller share of CO2) creating a productive use for the CO2 rather than having to scrub it from the biogas. Source: Net-Zero Emissions Opportunities for Gas Utilities, American Gas Association Study prepared by ICF.

- Ibid, p.5.

- (2022) Shell to acquire renewable natural gas producer Nature Energy. Shell Global.

- Total Energies picks up pace in biogas. TotalEnergies.

- Gas composition standards are regulations cover a wide range of components in natural gas including sulfur, moisture, energy content, siloxanes (silica from landfill and waste water sources), etc. include: European Norm EN 16723-2, Natural gas and biomethane for use in transport and biomethane for injection in the natural gas grid; ISO 13686: 1998 Natural gas - Quality designation; ISO 15403-1 Natural gas for use as a compressed fuel for vehicles, Part 1: Designation of the quality; and others nationally and internationally.

- (2022) REPowerEU: The Role of Biomethane. European Biogas Association, Belgium, Europe.

- Cit. World Energy Outlook 2022.

- (2019) International Energy Agency Task Force 41 report. Cost Reduction Biofuels p. 32.

- (2021) Biogas: Pathways to 2030. World Biogas Association p. 21.

- Cit., World Energy Outlook 2022 p. 394.

- Biofuels International, quoting the International Energy Agency, 7 Dec 2022

- (2023) The U.S. National Blueprint for Transportation Decarbonization: A Joint Strategy to Transform Transportation.

- Cit. World Energy Outlook 2022 p. 281.

- p. 3.

Top Editors

-

Mark E Smith

Bio chemistry

University of Texas Medical Branch, USA -

Lawrence A Presley

Department of Criminal Justice

Liberty University, USA -

Thomas W Miller

Department of Psychiatry

University of Kentucky, USA -

Gjumrakch Aliev

Department of Medicine

Gally International Biomedical Research & Consulting LLC, USA -

Christopher Bryant

Department of Urbanisation and Agricultural

Montreal university, USA -

Robert William Frare

Oral & Maxillofacial Pathology

New York University, USA -

Rudolph Modesto Navari

Gastroenterology and Hepatology

University of Alabama, UK -

Andrew Hague

Department of Medicine

Universities of Bradford, UK -

George Gregory Buttigieg

Maltese College of Obstetrics and Gynaecology, Europe -

Chen-Hsiung Yeh

Oncology

Circulogene Theranostics, England -

.png)

Emilio Bucio-Carrillo

Radiation Chemistry

National University of Mexico, USA -

.jpg)

Casey J Grenier

Analytical Chemistry

Wentworth Institute of Technology, USA -

Hany Atalah

Minimally Invasive Surgery

Mercer University school of Medicine, USA -

Abu-Hussein Muhamad

Pediatric Dentistry

University of Athens , Greece

The annual scholar awards from Lupine Publishers honor a selected number Read More...